The busy week of earnings reports ended with Warner Bros. Discovery on Thursday reporting their first quarter results. Unfortunately, it showed the company missing both its revenue and profit goals. Total quarterly revenue was $9.66 billion, a 7% decline year-over-year and significantly lower than the consensus estimate of $10.23 billion. While its losses of $966 million were an improvement over last year’s Q1, they were also significantly deeper than most analysts had predicted.

The most positive note in the report was an upward trajectory for the company’s streaming division. Its direct-to-consumer streaming business generated a profit of $86 million, fully $50 million better than the results reported from last year’s Q1. Ad revenue on streaming platforms also increased by 70%, boosted by results from Max’s ad-supported tier of service.

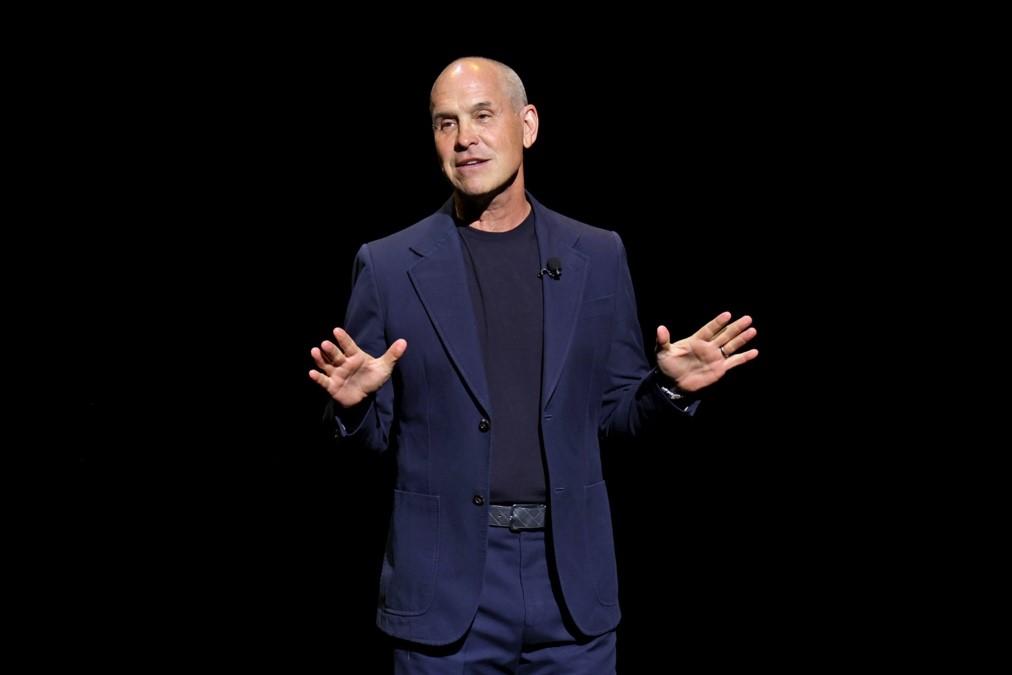

The company also announced that it would be partnering with Disney to offer a joint streaming bundle this summer made up of Disney+, Hulu, and Max. WBD CEO David Zaslav cited bundling as an effort to reduce churn in its streaming platform, a trend that Zaslav described as a “killer” to prospects of success in the streaming business.

Despite significant revenue growth in streaming, Warner Bros. Discovery saw even bigger declines in revenues from its cable assets. TV network revenue fell 8%, with associated ad revenue down by 11%. The company is negotiating perilously with the NBA to renew its broadcast rights, which are set to expire after this year’s playoffs. The NBA is entertaining competing offers from Amazon and Comcast to broadcast future seasons. The company’s current deal with the NBA to broadcast games on its TNT network is easily its most valuable sports asset.

Either outcome could be perilous for Warner Bros. Discovery. On the one hand, the company could struggle if it extends itself too far to keep the NBA on TNT. On the other hand, the NBA is one of the few programs that keeps a mass audience tuning in to watch cable TV. While Zaslav claims that his company has the interest and ability to match any competing offer, analysts are dubious that doing so would be the best course forward.