Warner Bros. Discovery reported weaker-than-expected results for the second quarter, with revenues coming in at $10.36 billion for the period resulting in a net loss of $1.24 billion. Both numbers were slightly below Wall Street’s expectations.

Revenue from theatrical releases declined by 23%, in large part due to an underperformance of the DC Studios title THE FLASH. Cable networks’ revenue declined by 6% due to a weak advertising market.

There was a net drop in active subscribers to the company’s streaming services, in the wake of a high-profile merger of HBO Max and Discovery to create the newly branded “Max” service. At the end of Q2, there were 95.7 million Max subscribers, which is down 2 million from the total number of subscribers for the separate services as of the end of Q1. Industry watchers observed that much of this decline was due to former Discovery+ subscribers not continuing their subscription under the Max service.

On the bright side, the combined company continues to chip away at paying down the mountain of debt it accumulated through last year’s merger of Warner Bros. and Discovery. After paying off $1.6 billion of debt during the quarter, a substantial $47.8 billion remains on the books.

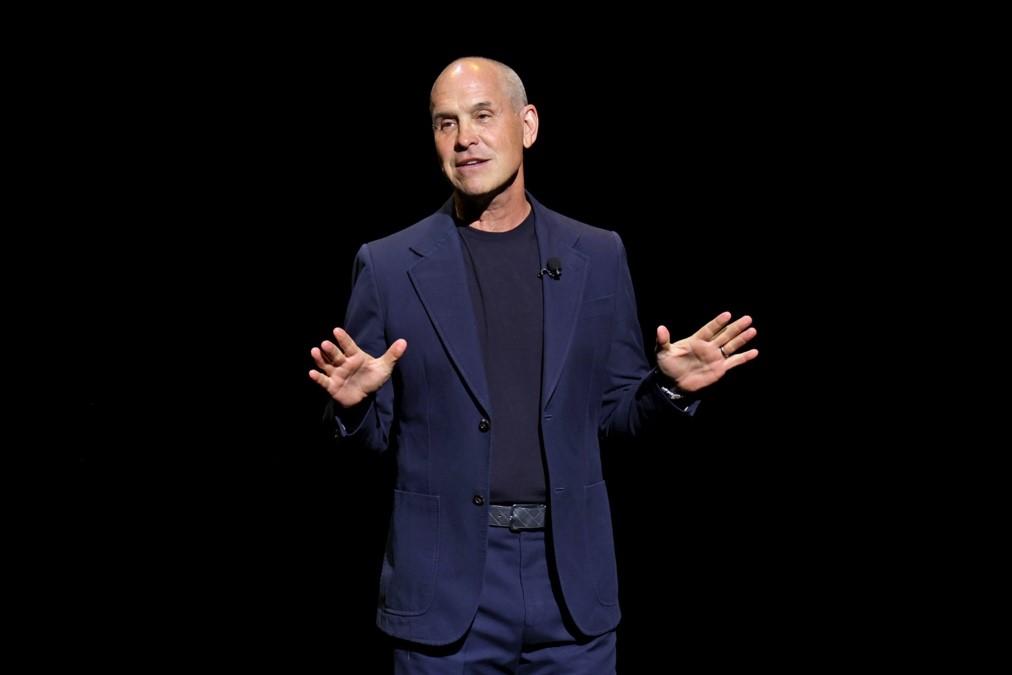

CEO David Zaslav tried to spin the results by highlighting the company’s progress on reducing debts and the excitement over the upcoming introduction of high-end “news” and “sports” content on Max, although no specific timeline for this was given.

This mirrors the strategy outlined recently by Disney CEO Bob Iger to lean into sports as a means to attract mass audiences to subscription services. WBD already has an established track record of success in these areas, as the owner of networks such as TNT and CNN.

See also: Max Will “Soon” Add News & Sports To Its Streaming Mix, Warner Bros. Discovery CEO David Zaslav Says, Though No Timeline Is Given (Deadline)