Warner Bros. Discovery and Paramount Global announced their second-quarter earnings last week, both notable for their short-term struggles to “align” their operations to succeed in an increasingly competitive market.

This was the first quarter for which Warner Bros. Discovery reported combined financials, following their blockbuster merger which was announced in May 2021. The company reported lower-than-expected revenues and growth in new subscribers for its streaming services. In fact, one of last week’s eye-catching announcements was the likelihood that it would combine its Discovery+ and HBO Max streaming services into a single offering by the summer of 2023.

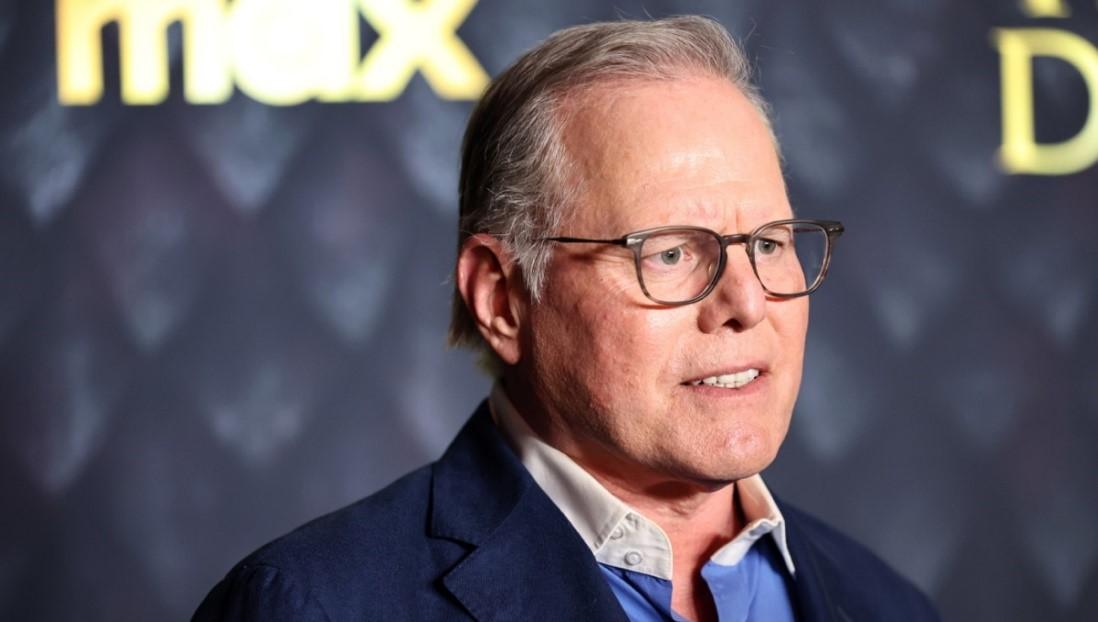

Warner Bros. Discovery stock dropped sharply on the report, with significant layoffs and restructuring expected ahead. In a lengthy earnings call, CEO David Zaslav told investors that the company planned to invest more in its traditional cable and theatrical platforms and back away from the “all in” approach to streaming that had been the strategic focus of his predecessor, WarnerMedia CEO Jason Kilar.

Paramount Global’s second-quarter earnings also pointed to challenges and hard work ahead. Despite strong growth in subscriptions for Paramount+ and the massively successful theatrical releases TOP GUN: MAVERICK and SONIC THE HEDGEHOG 2, overall earnings were lower than last year due to falling ad revenue from its television channels and increasing costs to acquire and produce content for its streaming channels.

In contrast to Warner Bros. Discovery, Paramount CEO Bob Bakish announced that it would continue to “focus intently” on building market share in streaming, as well as growing ad sales on Paramount+ and Pluto.

See Also: Streaming Investment Spurs Profit Drop in Paramount Global Q2 (Variety) and Warner Bros. Discovery CEO David Zaslav embraces the past as he plans his company’s future (CNBC)