One outcome from the U.S. presidential election is expected to be a much more supportive environment for corporate mergers, large and small. Within the entertainment industry, a renewed wave of mergers could emerge, spurred on by lower corporate taxes, stabilizing interest rates, and a laissez-faire attitude by the U.S. government towards buyouts.

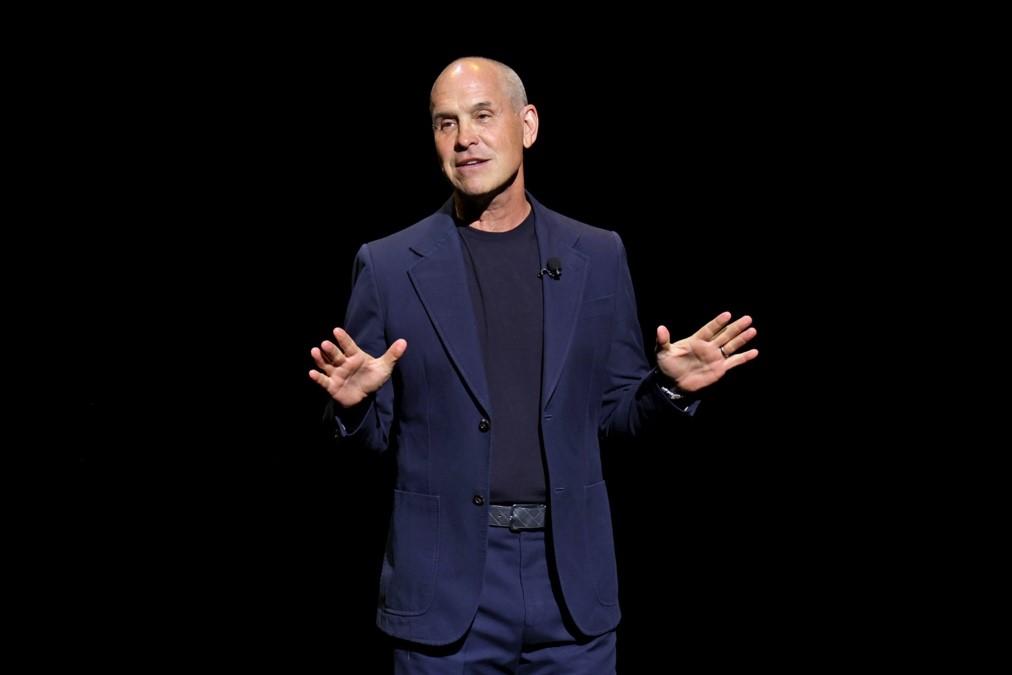

Warner Bros. Discovery CEO David Zaslav commented last week that he believes the incoming Trump administration will spur “a pace of change and an opportunity for consolidation that may be quite different” than under the current administration. He believes that this will have “a real positive and accelerated impact on this industry that’s needed.” It could also be an indication of the specific circumstances at WBD, which is struggling to manage $40B in outstanding debt.

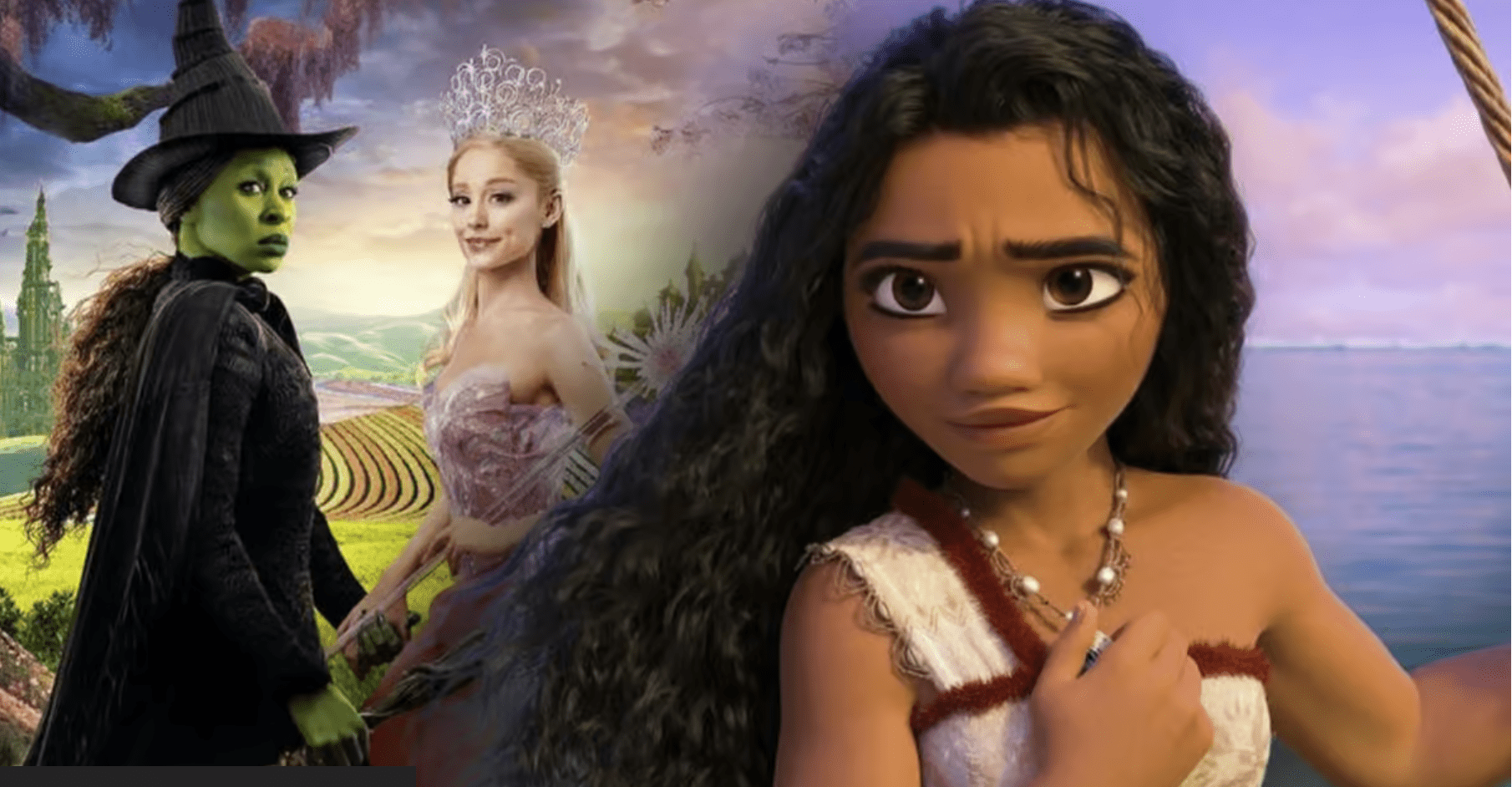

Over the past 20 years, the entertainment industry has been transformed by mega-mergers, including Disney’s acquisitions of Pixar, Marvel, Lucasfilm and 20th Century Fox, AT&T’s takeover of Time Warner, Comcast’s onboarding of NBCUniversal and Amazon’s buyout of MGM. While some deals have worked out well, many others have not.

Biden’s Federal Trade Commission under the leadership of Lina Khan clamped down on new deals, seeing most as anti-competitive and contrary to the interests of consumers. This contributed to Sony deciding not to pursue an acquisition of Paramount, fearing pushback from regulators that would require significant legal fees and an uncertain result. Meanwhile, industry CEOs including Zaslav and former Sony CEO Tony Vinciquerra are predicting “chaos” ahead for the entertainment industry.