With news that Paramount and Skydance have finalized their merger deal, the spotlight is turning to Warner Bros. Discovery which is seen by many as the media giant now suffering under the most financial strain. The company’s share price has dropped by 70% since Warner Bros. and Discovery combined forces in April 2022.

A large part of this decline is due to the diminishing value of the company’s cable TV networks. Last month WBD wrote down the value of cable networks by $9 billion after losing the broadcast rights to upcoming seasons of the NBA.

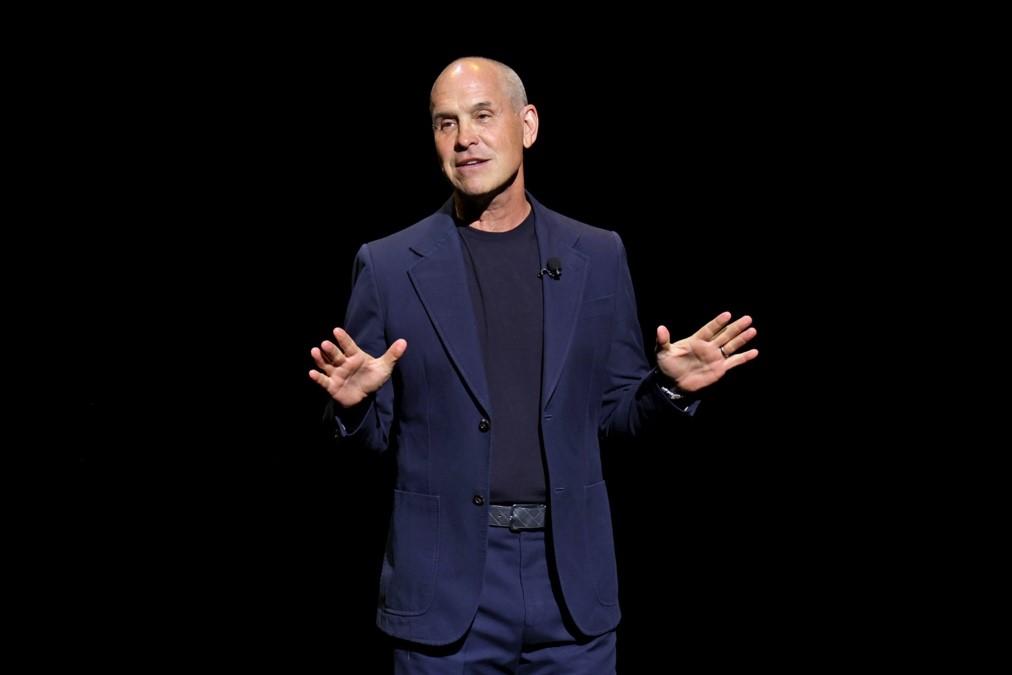

On Wednesday at the Bank of America Media, Communications & Entertainment Conference, Sony Pictures Entertainment Chairman Tony Vinciquerra took his turn at forecasting a rocky road for certain media giants. Vinciquerra said that he sees “chaos” within the sector over the next few years, with “mergers and bankruptcies and sales and all kinds of fun things.” He points to certain companies in particular that “have this albatross of cable networks around their necks that they have to figure out what to do with.”

Sony is alone among major studios to not have the financial burden of either owning legacy cable networks or a mainstream streaming platform. They have pursued a lower-risk strategy focused on content creation and distribution. Their mainstream movies have often been distributed to theatres, before appearing online, or have gone directly to streamers such as with their widely publicized deal with Netflix.

This has allowed Sony to run with a lower cost profile than the “all-in” media companies such as Paramount, Warner Bros. Discovery, Disney, and NBC Universal that maintain both studios to create content as well as direct-to-consumer streaming platforms under their brand.

Warner Bros. Discovery CFO Gunnar Wiedenfels also appeared at the same BofA conference, where he acknowledged a “decline” in the linear cable business and said that his company would be making “rational” decisions around its future.

Some reports have surfaced that WBD is considering selling off some of its cable networks such as CNN to pay down some of the $40 billion debt that the company holds on its books. Some analysts are suggesting that the company could even separate its linear cable assets from its streaming and studio business as a move of last resort.