March 2022 already marked the start of the third year in which the global theatrical industry has been impacted by the COVID-19 pandemic. Thankfully it was by far the best performing March of the pandemic era with a total of $1.8 billion! That is $1 billion more than recorded in March 2020 (+138%, $750bn), when the first global wave of the pandemic shut nearly the whole industry down for the second half of the month. It is also a significant uplift against March 2021, nearly doubling its $973 million results (+83%).

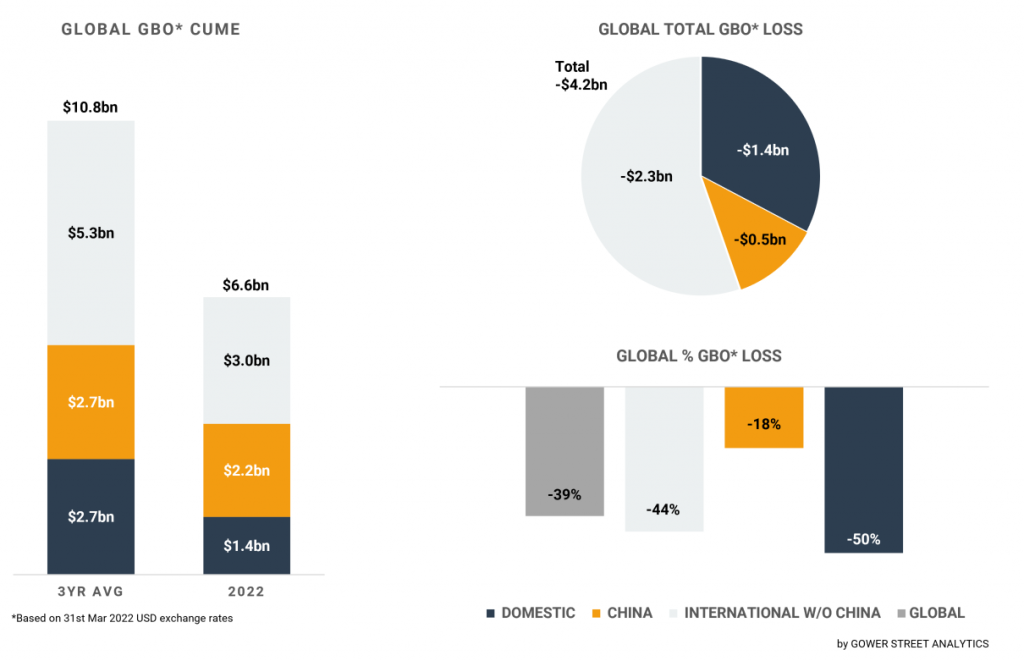

The total global box office for Q1 2022 is estimated at $6.6 billion. This is currently tracking 56% ahead of 2021 ($4.2bn) at the same stage but is still -39% (-$4.2bn) behind the average of the last three pre-pandemic years (2017-2019). After just three months, 2022 has achieved over half (56%) of the 2020 full year total ($11.8bn) and is shy of a third (31%) of last year’s $21.3 billion results.

On this month’s Global Box Office Tracker (GBOT, above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China, and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three pre-pandemic years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

The main driver of growth in March was the Domestic market with a box office of $597 million; the market’s third-best month of the pandemic! This was more than five times as high as March 2021 (+410%, $117m) and more than double 2020 (+133%, $256m). The Domestic result represents just over a third (34%) of the month’s global box office – the highest share taken by the Domestic market in the last two years. Despite this impressive growth, the month was still -40% below the month’s 2017-2019 average.

The International market (excluding China) also enjoyed a good month with a box office of $1.03 billion. This is the 4th best month of the pandemic, just slightly behind January 2022 ($1.08bn) and on par with July ($1.02bn), August ($1.04bn), and November ($1.0bn) last year.

In contrast, China had its worst monthly performance since July 2020, when cinemas started to re-open after six months of closure. March’s $143 million is not even half the second-worst month’s result so far from November 2020 ($293m)! As COVID-19 cases rise again, China has seen a drastic reduction in the number of cinemas open by market share. It dropped from 87% at the beginning of March to 54% at the end of the month.

The major portion of the global box office in March was delivered by one title: THE BATMAN, with a box office of approximately $690 million within the month. Without major competition, Matt Reeves’ iteration was able to play strongly through the month with mostly just moderate weekly drops. Many of the highest-grossing territories saw THE BATMAN deliver a market share (MS) of at least 50% of the month’s total. Domestic was clearly ranked #1 globally with $338 million, representing 57% of the market’s total in the month. It’s already the second highest-grossing title domestically of the pandemic. That outstanding result is followed by UK/Ireland with $48.6 million (54% MS), Mexico with $28.4 million (56% MS), Australia with $24.8 million (50% MS), and Brazil with $20.8 million (73% MS).

With the lack of additional global tentpole releases in March, the February holdover performance of UNCHARTED provided strong support in multiple major markets. At #2 in March UNCHARTED added $51 million in Domestic, $6.7 million in France, $6.7 million in UK/Ireland, $6m in Germany, $4.8 million in Australia, and $2.1 million in Brazil. The title now has a worldwide cume of $373 million (Domestic $139m, Intl $234m).

Both titles lifted the Domestic and International box office (excluding China), but were not able to do the same in China. THE BATMAN and UNCHARTED opened there in March after the country had passed on multiple US blockbusters in the last year. Unfortunately, both arrived at the same time as the aforementioned re-closure of cinemas. Especially strong internal markets like Shanghai were impacted. In March THE BATMAN did $19 million at #3 in the market, while UNCHARTED came in #4 with $15 million. Both results pale by prior year standards. While cinema closures surely had an impact on the disappointing outcomes for THE BATMAN and UNCHARTED, the results also fuelled the fear that audience tastes toward imported movies have changed in China.

One of the encouraging aspects of March was the rise of international and so-called alternative titles. This content helped to fill theaters around the world earlier in the pandemic when the frequency of wide-released blockbusters was low. BTS: PERMISSION TO DANCE ON STAGE – SOUL, JUJUTSU KAISEN 0, and RRR were the March highlights in that segment. This is especially noteworthy as these titles tend to attract audiences that more rarely or barely ever go to cinemas.

On March 12 Korean boy band BTS’ latest offering: BTS: PERMISSION TO DANCE ON STAGE – SEOUL set a record for a global event cinema release. It delivered a phenomenal $32.6 million on its single-day release from 75 territories. In Mexico, it even delivered the second-highest gross for any movie released in the month ($5.8m)!

In its country-of-origin Japan, JUJUTSU KAISEN 0 is already the second highest-grossing film of the pandemic era, with a current total of $116 million. In March it saw its successful international rollout with terrific results at the top end of anime releases. In Domestic it was the #4 title of the month with a $29.5 million box office. In Mexico ($1.5m) and Australia ($1.3m) it ranked #6, in Germany ($1.6m) #7 and in UK/Ireland ($1.7m) like France ($3.3m) it finished #8. Globally its total is now $176.2 million!

The high-budget RRR from India was a highly anticipated movie. Its global total is currently at $112 million, primarily from India but also with impressive contributions in multiple countries. RRR was the #3 movie of March in the UAE with $1.9 million. In Australia ($1.9m) it got to #4, in Domestic ($11m) #8 and in UK/Ireland ($1.1m) #14.

The expected challenging Q1 is done. The theatrical industry weathered the low frequency of tentpoles and the record number of Covid cases in that period. Cinemas stayed open, globally above 80% by market share. Most of the released titles performed to or above expectations. While the recovery has slowed down compared to the end of 2021, it hasn’t stopped. The theatrical industry is in a much better position than at the same time in either of the prior two years.

Twenty-six of the 30 territories tracked in our State Of The Market report are clearly tracking above their 2021 Q1 cume! While Taiwan is nearly on par (-2%), Russia (-18%), China (-22%), and Hong Kong (-75%) are the only ones obviously tracking behind. However, those cases don’t put an increased risk on the global recovery as the reasons are mainly territory specific, especially with Russia’s aggression-caused US studio boycott and China’s restrictive Covid-19 policy.

A year ago, GODZILLA VS KONG opened and became the first global blockbuster of the pandemic, a year after Covid-19 reset the clock. It took another three months for the next one to arrive. This time THE BATMAN was released three months after the last global hit (SPIDER-MAN: NO WAY HOME) and a phalanx of strong movies are due in the upcoming weeks and months. In 2021 Q1 finished with just 63% of cinemas open by market share, although being a peak in over four months. Currently, the global market is at 80%, a target not reached before June last year!

The LOST CITY had a successful Domestic launch in March bringing missed female audiences back to cinemas. Its international rollout follows in April. From now on the release schedule for this year is substantially more filled with wide releases. Already in April, nearly on a weekly basis, attractive offerings are being released with MORBIUS, SONIC THE HEDGEHOG 2, FANTASTIC BEASTS: THE SECRETS OF DUMBLEDORE, and DOCTOR STRANGE IN THE MULTIVERSE OF MADNESS! The recovery is expected to speed up again immediately!