IMAX’s Q4 results demonstrated several unique strengths that the exhibitor enjoys with its business model. As with all other exhibitors, IMAX saw overall revenues decline in the fourth quarter, dropping 12% from last year’s fourth quarter. Profits were off 11% compared to the prior year. This was due in large part to the relative weakness of new releases compared to last year, with the top films of Q4 2023 including TAYLOR SWIFT: THE ERAS TOUR, AQUAMAN 2, and WONKA. Last year’s top performer at IMAX locations was AVATAR: THE WAY OF WATER.

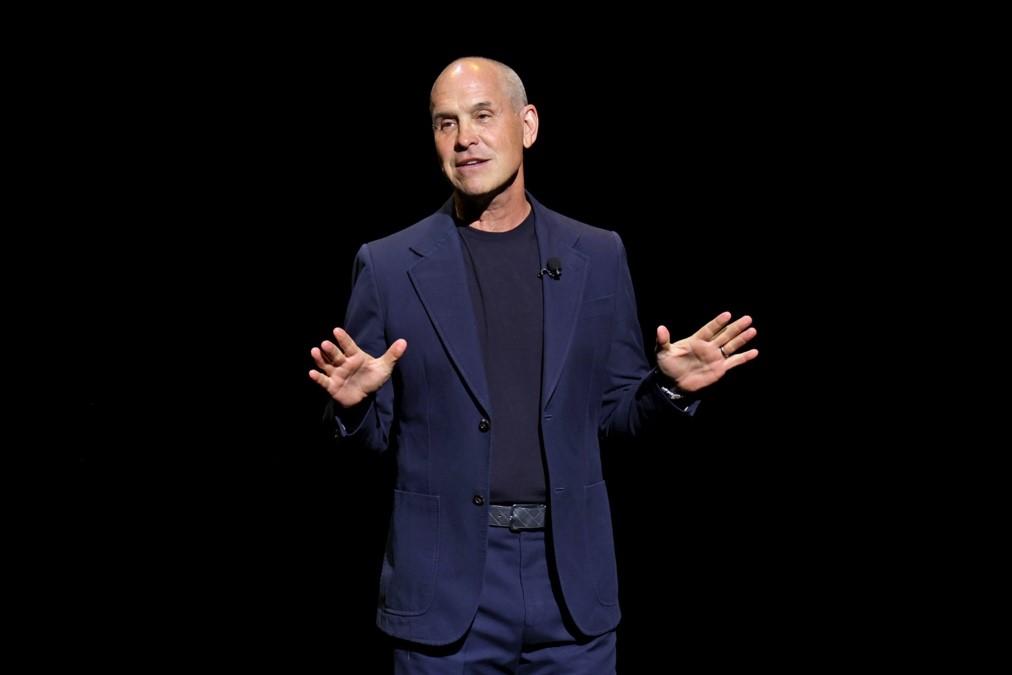

Despite the declines in domestic box office, IMAX shares were trending up by the end of the week due to strength in other parts of its business. IMAX surprised analysts with solid results from its products and service division, which delivered more than 60 new installations of IMAX technology across the key strategic markets of Japan, South Korea, and Europe. IMAX CEO Rich Gelfond targeted these installations as a key to growth, saying that his company still has only “47% penetration [of global markets] with the opportunity to open nearly 2,000 additional locations worldwide.”

IMAX shares were also buoyed by a strong annual result, with revenues increasing by 25% to $375 million, the second-highest revenue in any year in the company’s history. Local-language movies in China, India, and France continued to produce strong box office results. These trendlines support the argument that the dip in revenues and profits in Q4 was a one-off due to external factors and that the exhibitor will overperform its competitors who do not benefit from having the same diversified portfolio as IMAX.