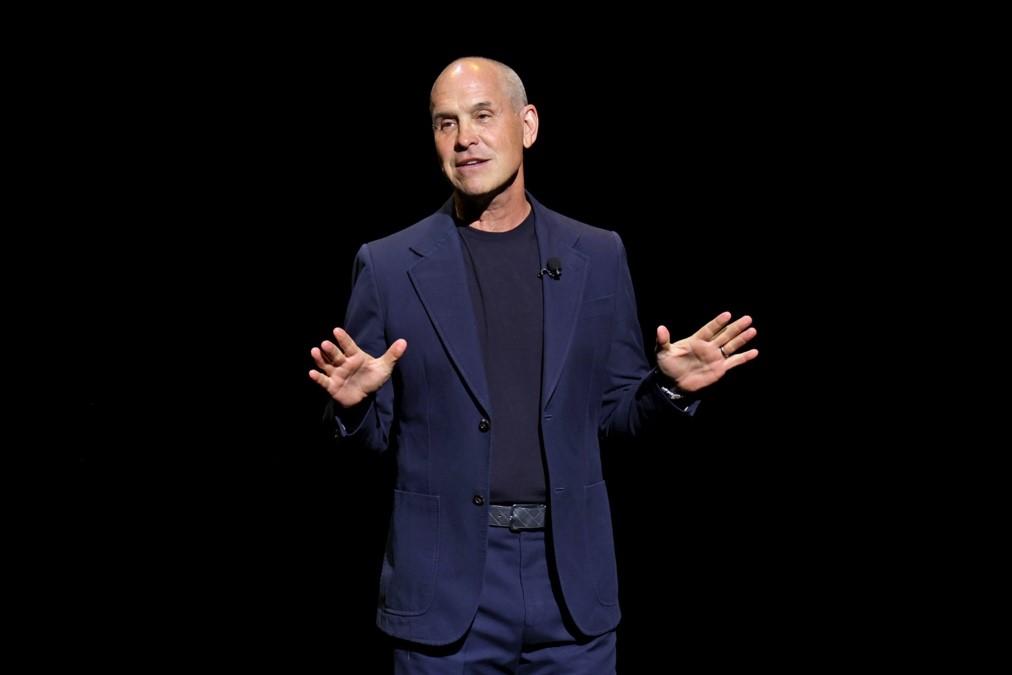

This week, Disney reported its Q3 earnings with largely positive results in both streaming and theme parks. The company exceeded its forecast for new subscribers to Disney+ after adding over 7 million new signups during the quarter and narrowed its losses in streaming year-over-year. CEO Bob Iger attributed the strong growth in subscribers to the availability of movies such as GUARDIANS OF THE GALAXY VOL. 3, ELEMENTAL, and THE LITTLE MERMAID.

Disney’s Parks, Experiences, and Products division also reported strong earnings with a 13% uptick in revenue year-over-year. Much of this increase was attributable to Disney’s theme parks, which account for two-thirds of the revenue from the division.

The combined impact of this positive earnings report and the end of the actors’ strike lifted Disney’s share price by as much as 7% by Thursday and finished the week 3.7% higher than it began.

Iger spoke about “building blocks” for Disney going forward, which consist of solid businesses in the areas of streaming, theme parks, cruises, movie studios, and the ESPN sports network. Iger laid out bold objectives, with its streaming division becoming profitable by this time next year, ESPN becoming a streaming-only entity by 2025, and identifying $2 billion in additional cost reduction, raising that goal to a total of $7.5 billion since he returned as Disney CEO last fall.

Despite the positive news, many doubts remain about Iger’s ability to accomplish these lofty goals. Disney is mired in an epic slump with its studio business, underlined by this weekend’s disappointing results for THE MARVELS, the ongoing search for a “strategic partner” for ESPN as it transitions away from cable channel and into streaming. Iger claims to have fully embraced these challenges, saying “A lot of time and effort was spent on fixing in the last year…We’re all rolling up our sleeves, including myself, to do just that.”

See also: Iger Lays Out Vision for Disney’s Future (Wall Street Journal)