The COVID-19 virus crisis has been a meteoric event for the theatrical industry. Over the past eleven months, no market has escaped the impact. All markets have taken big hits and some doomsayers have suggested the threat of an extinction-level event. A coordinated global effort has been unfortunately absent across this tripartite business, which depends on real estate, operations, and products to flourish.

However, some markets have staged a comeback, showing it is possible to face the challenge and come through bruised but not beaten. This has largely been achieved in markets with strong local content, able to help fill the void left by the lack of Hollywood titles. These markets have effectively sent their astronauts (or oil-drillers!) to minimize the threat as best as possible. Some splash-down was, regardless, inevitable.

Ripples continue to be felt. This past week alone: Universal struck further deals with Cinemark and Canada’s Cineplex, following its deal with AMC, to allow the studio to release movies grossing less than a $50 million Domestic opening weekend to VOD platforms after a 17-day window, while those grossing $50 million or more will be allowed to make the VOD move after 31 days; Warner Bros announced that, in the Domestic market, WONDER WOMAN 1984 would be released simultaneously in theaters and on HBO Max on Christmas Day; it was revealed that Cineworld Group is exploring debt-restructuring and potential site-closure options in the UK; and PETER RABBIT 2 became the latest title to move out of Q1 to a, perceived, safer Q2 slot.

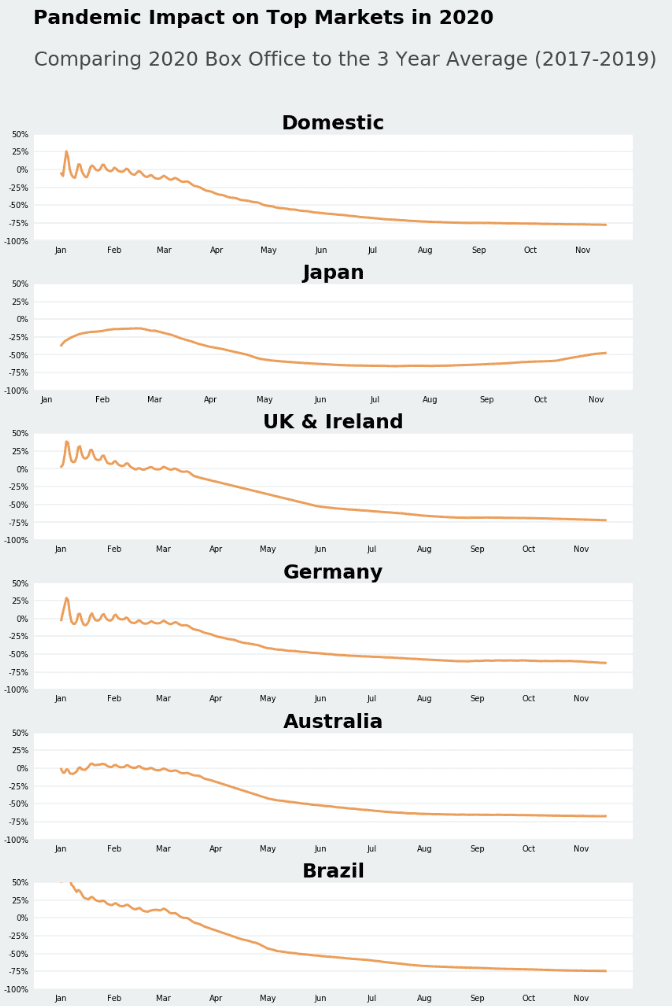

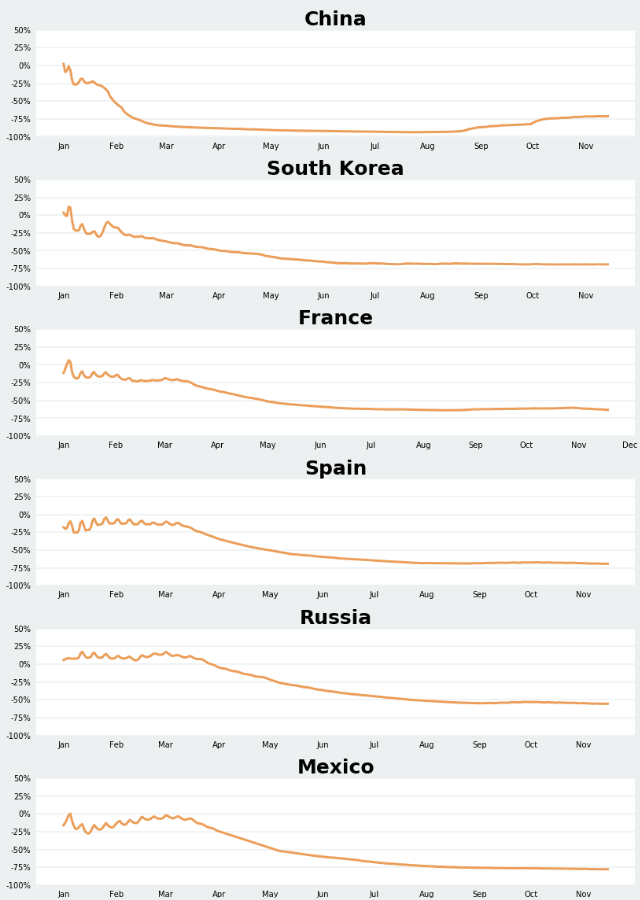

This week Gower Street looks at how each of the top 12 global box office markets has been impacted by data. The 12 graphs below compare how the 2020 box office has tracked throughout the year to date (x-axis displaying months) compared to an average of the past 3 years in each market (y-axis displaying percentage change, ranging between +50% to -100%).

As can be seen on the y-axis, the markets in the strongest positions heading into the crisis were the UK/Ireland, Russia, and Brazil – all posting strong first quarters. UK/Ireland benefitted greatly from the January 10 opening of Sam Mendes’ 1917 ($57.4m) which helped ensure the market could begin the fateful month of March still slightly ahead of the average despite some disappointing February releases. At the beginning of March, Russia was 17% ahead of the 3-year average, only first showing a deficit on March 28.

Brazil got the best start to the year of any of the 12 major markets as local holdover hit MY MOM IS A CHARACTER 3 (a Dec. 26 release – $35m in 2020) combined with the Jan. 2 release of FROZEN II ($30.6m) to draw in massive audiences. Heading into February the market was tracking approximately 20% ahead of the average. The market held off moving into deficit until March 13 (cinemas began to close in the market ahead of the March 12 weekend). However, since then Brazil has been hit hardest of these three markets, having endured the longest period of closure of the three, and currently stands 74.7% behind the average.

UK/Ireland was never able to make significant in-roads upon re-opening, lacking a strong pipeline of local content and a mass audience used to engaging with local products. The deficit has continued to steadily increase and is now over 72% behind the average. In contrast, Russia managed to marginally decrease its deficit in early October and currently stands 55.5% down. The Eastern European major benefitted not only from a few strong local titles but also a theatrical release for MULAN ($5.3m), which the UK was denied.

France also showed that it was having some limited success in fighting back. The market, which has the strongest pipeline of local content among the six European majors, at a poorer start to the year than the UK, showing a deficit immediately. By the end of Q1, France was already tracking nearly 36% behind the 3-year average, however, coordinated market re-opening and a steady stream of content (albeit smaller than normal) enabled the market to start decreasing its deficit slightly (from a nadir of -63.7% back to -60.2%) before a new national lockdown from Oct. 30 halted the positive progression. A similar, if smaller, trend was seen in Germany, although the market had a better start.

The Domestic market did not enjoy as strong a start but was just about managing to stay on par with the average until about mid-February (something Australia also managed). Then results started to decline steeply and by the end of the Q1 box office nearly 34% behind the 3-year average. Despite theaters re-opening the decline has at no point been arrested and the former #1 global market is now tracking 77.7% behind the average of the past 3 years – the second-worst deficit of any of the 12 major markets, narrowly behind Mexico. Australia has followed a similar pattern to Domestic, holding roughly on par well into February but then experiencing a largely unfettered decline since (to -67.3%).

The market that hit hardest early was China, although it is also the market to stage the greatest comeback. Chinese box office nose-dived in January due to a shutdown that came nearly two months earlier than most other territories. It also dropped to a deeper deficit (-93.4%) than any other market has missed out on the lucrative Chinese New Year week in late January. However, China displayed a notable comeback with the deficit now reduced to 71.2%.

Japan also shows a notable comeback and is currently in the most robust shape of any major market with a deficit against the average of under 48% (having reached over 66% at its nadir). This is all the more impressive when it is noted that Japan had been in deficit right from the start of 2020.

Like Japan, South Korea, France, and Spain, Mexico was also in deficit from the get-go. By the end of Q1, the Latin American major was already nearly 24% against the average of the past 3 years. It is now 77.8% behind the average – the worst hit of the 12 major markets.

If you have comments or questions about Gower Street’s charts and articles; to see higher-resolution images; sign up for our free newsletter; or subscribe to our Road To Recovery reports, which track all the latest news and information around the world, please visit our website at: https://gower.st