Cineworld submitted its plan for restructuring to the U.S. Federal Bankruptcy Court this week, confirming details widely reported over the last several weeks.

Under the plan, Cineworld’s lenders will wind up owning most of the company after a debt-for-equity swap, with current shareholders, left hanging out to dry. The exhibitor also confirmed its intention to maintain control of its theatre locations in the U.S., U.K., and Ireland, but look for buyers for its theatre locations in other European countries and Israel. These arrangements have been agreed to by the company’s Board of Directors and its debt holders but still need to be approved by the U.S. Bankruptcy Court as well.

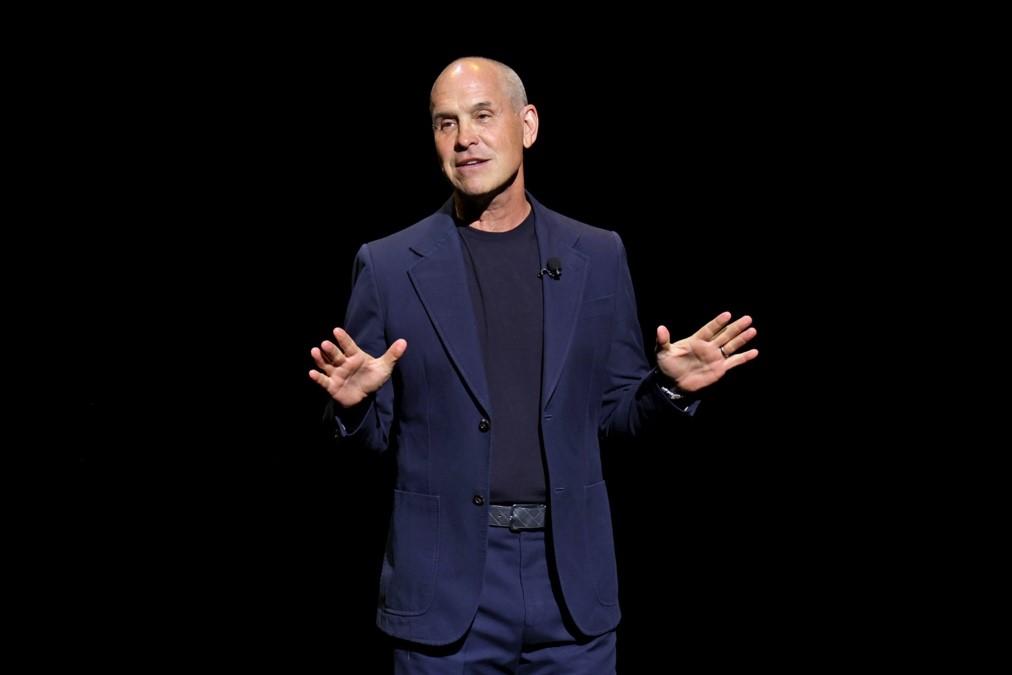

Cineworld CEO Mooky Greidinger proclaimed the plan as a “vote of confidence” in the future of Cineworld and the exhibition sector, avoiding the massive disruption from widespread theatre closures at the second-largest exhibitor in the U.S.

See Also: Regal to Reopen Pasadena’s Former ArcLight Theater (Los Angeles Times)