AMC reported its first-quarter earnings this week, showing a slight year-over-year decline in revenue. The world’s largest exhibitor trended down across all key metrics: theatre attendance, box office, and concessions sales.

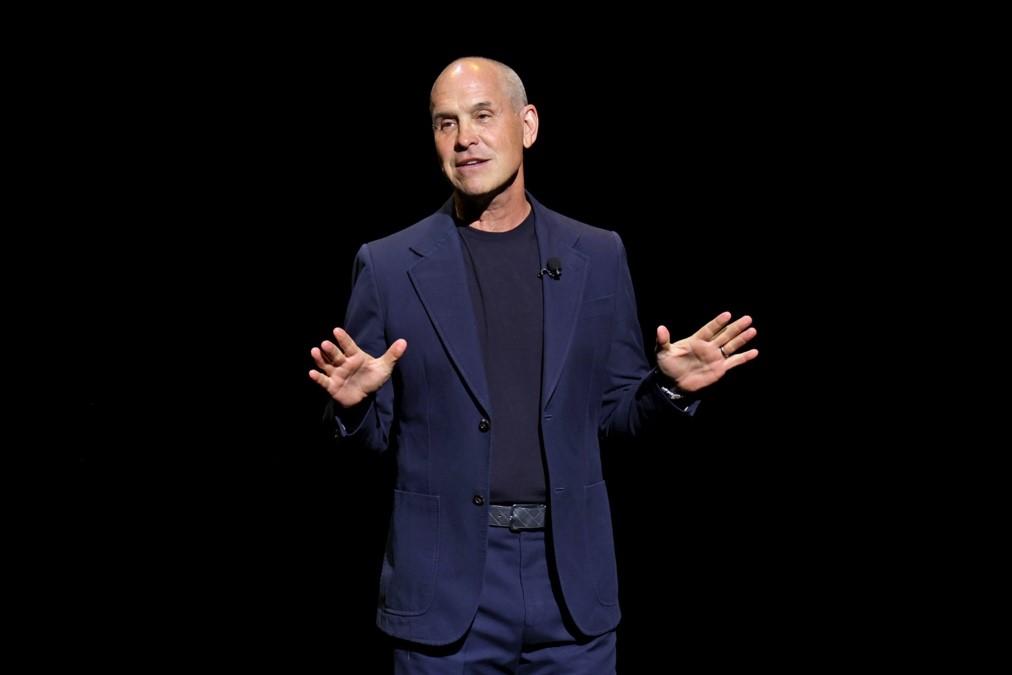

The box office came in at $530.5 million, compared to $534.1 million in last year’s Q1 while concessions were $321.2 million compared to $328.7 million. AMC CEO Adam Aron pointed to the impact of last year’s strikes by writers and actors as a primary cause, creating a “near-term box office challenge.”

Even with this drop, AMC’s revenues and profits were higher than most analysts had expected, with losses narrowing from $235.5 million in Q1 2023 to $163.5 million in the most recent quarter. However, the exhibitor remains burdened by over $4.5 billion in outstanding debt and a projected decline in revenues during the year’s second quarter.

Aron explained that he expects Q2 2024 to “fall significantly below last year’s second quarter,” based on a relatively unfavorable film slate compared to last year’s second quarter, including hits such as THE SUPER MARIO BROS. MOVIE, GUARDIANS OF THE GALAXY VOL. 3, and SPIDER-MAN: ACROSS THE SPIDER-VERSE.

Given these challenges, some are convinced that AMC will be forced into bankruptcy to shed debts and re-organize its business. Aron has fought hard to avoid this path, and during the Q1 earnings call he stated that the company has $624 million in available cash and a good relationship with their lenders, who “have worked with us before, are working with us now.” But investors remain skeptical, with AMC’s share price wallowing at near 12-month lows despite posting results that exceeded most pre-release estimates.