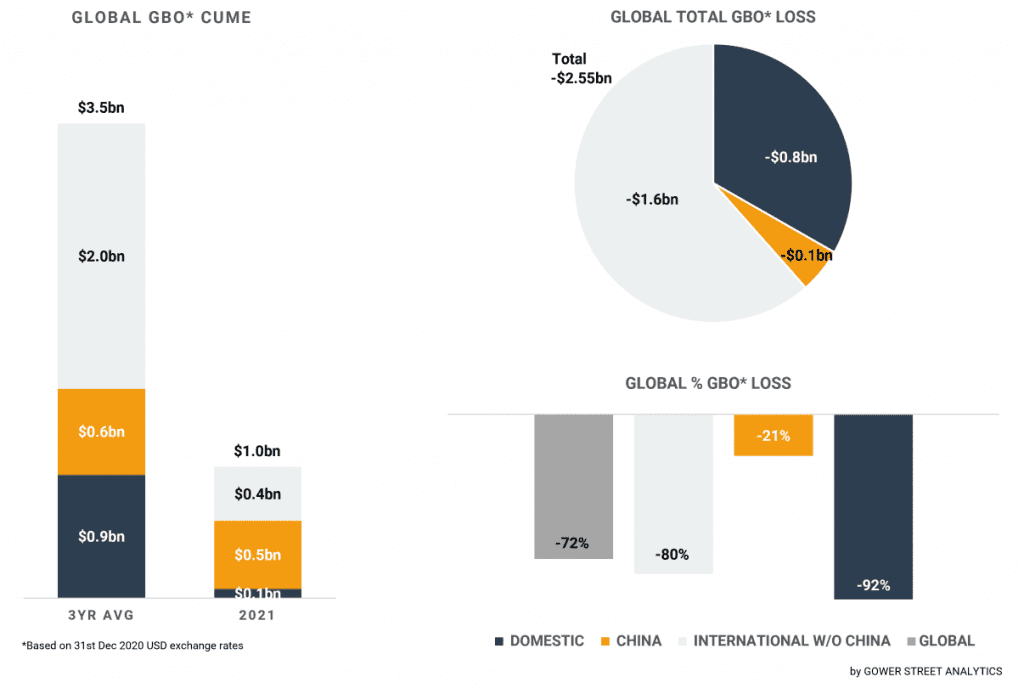

The New Year continues where the old one left off. In January, global cinemas accounted for $1 billion box office. Although this is slightly down from December’s $1.1 billion, the result remains in the same ballpark as most months since August. From a global box office perspective, things are not getting worse, but nor are they finally improving yet. At the end of January, the current 2021 global box office deficit compared to the average of the last three pre-pandemic years (2017-2019) is already -$2.55 billion, a drop of -72%.

Half of the global box office in January was again delivered by China with $0.5 billion. It is the third-best monthly box office result since the beginning of last year and on par with August. China is only 21% and $0.1 billion behind the three-year average. Any deficit is shown is mainly due to the lucrative Chinese New Year falling on January 28, 2017 (instead of in February), inflating the loss slightly.

The second-highest box office in January was achieved across the International market (excluding China), with $0.4 billion. This is the lowest monthly international box office since July. With just one month in the new year past, the deficit against the three-year average is already -$1.6 billion, -80% behind.

The Domestic market continues to be the slowest growing, again contributing only $0.1 billion in January. The performance roughly mirrors that of the final two months of 2020. After the first month of 2021, Domestic is tracking -92% behind the three-year average, a total of -$0.8 billion!

The stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China, and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three (pre-pandemic) years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

One year after the closure of Chinese cinemas marked the first sign of the impact the COVID-19 virus was going to have on the global box office, the country is performing again on pre-pandemic levels. In China, the January box office was dominated by three year-end-released local titles that accounted for over 70% of all grosses in the month.

A LITTLE RED FLOWER led the trio with $168 million of its current $209 million within the month, followed by WARM HUG with $95 million (now at $127m) and SHOCK WAVE 2 with $93 million (now at $190m). SOUL was the only international title that did significant business with $40 million of its current $54 million in January. SOUL is already the third highest-grossing Pixar movie in China, just a glimpse behind INCREDIBLES 2.

The January performance of the International market (excluding China) continued to be driven by the Asia Pacific. Nearly two-thirds (65%) of the International box office in that period was generated in the region. Although this is less than in the prior months, where levels around 80% were reached, it is still nearly double the share of pre-pandemic January (36%, avg. 2017-2019).

Japan remained the backbone of APAC’s increased international share. A bit over one-third (35%) of APAC’s results in January came from Japan. It’s decreasing from the levels at the end of the year (around 50%), but still significantly above the usual share of one-fifth. It has come down a bit primarily caused by the restriction of cinema capacity to 50% and their closure by 8 pm in Tokyo and three neighboring prefectures since January 8.

These have been established due to increased COVID-19 cases in that region. This triggered the delay of multiple planned local releases. With no competition coming in, the highest-grossing release of all time in Japan, DEMON SLAYER THE MOVIE: MUGEN TRAIN, dominated for the fourth month. Despite these challenges, Japan is just -36% behind the three-year average after one month in 2021.

In the middle of January, India, another Asian powerhouse, joined South Korea, China, and Japan in the group of blockbuster-producing countries in times of a global pandemic. The release of MASTER with superstar Vijay made an Indian release top the weekend global box office for the first time. Although most of MASTER’s $18m opening weekend total was coming out of its home country ($15m), the Tamil film drove business in International territories as well.

MASTER opened strong as clear #1 in Singapore and the UAE while breaking into the top ten in Australia, New Zealand, and Domestic. After this short-term success, the last week of January brought other welcome news with the announcement that Indian cinemas have been allowed to return to full capacity from February 1.

From one International accomplishment to another. In Russia, the first play-week of the year brought the first European market to achieve Stage 5 on Gower Street’s Blueprint to Recovery (measured as a weekly box office result equivalent to those in the top quartile of weekly business in 2018-2019). After China and Japan, it became only the third Comscore-tracked market to reach this milestone. Russia used the traditionally strong New Year period to achieve this and even repeated it the week after.

This success was headed by the local adventure sequel THE LAST WARRIOR: ROOT OF EVIL (now at $26.8m). It has already surpassed the lifetime of the first part and is now the 4th highest-grossing local title of all time. The uplift of the Russian market in January was further supported by local drama FIRE (now at $11.7m) and two US animated releases with DreamWorks Animation’s THE CROODS: A NEW AGE (now at $11.2m, already +3% above the original CROODS) and Pixar’s SOUL (now at $8.7m). Due to that, Russia is showing the second-lowest 2021 deficit among all Comscore-tracked markets after China, just -25% against the 3-year average at the end of January.

Conversely, the situation in the rest of Europe isn’t improving at all. Portugal became the latest country to close its cinemas on Friday, January 15. New restrictions were also re-imposed across multiple regions of Spain within the month. That lowers the number of cinemas open by market share to just 18% in EMEA, down from 23% at the end of 2020 and coming from a peak of 89% at the beginning of October. Given the recently extended restrictions in most major EMEA territories, this number will likely stay at a low level until at least March.

In Latin America, the number of cinemas open by market share ended roughly on the same level as last month, with 36% (+1%) down from a high of 64% in mid-December. The continuing high number of COVID-19 cases in Latin America prevents a significant recovery on the continent at the moment.

The same can also be said about the Domestic market. The number of cinemas open by market share has only increased slightly throughout January to 42%, from 38% at the beginning of the month. This is still far away even from the peak of 61% at the end of September. At least small recovery steps happened at the end of January, with AMC cinemas re-opening multiple sites across Illinois and movie theatres in Boston, Massachusetts, being allowed to re-open.

Globally the number of cinemas open by market share stayed at 56% by the end of January, the same as a month ago. This is down from a peak of 79% at the end of September. It has been at the lowest level since the middle of August, before TENET’s opening.

The outlook for February promises a significant uptick for the global box office. First and foremost, this is due to the Chinese New Year, which falls on Friday, February 12. It is historically by far the most lucrative theatrical season of the year in China. The global box office could potentially be pushed to the highest result within a year. That the territory that closed first in the pandemic is one year after performing nearly on the same level as before is an encouraging sign.

This is also true in the growing number of countries that are moving ahead on the road to recovery, such as Japan and now Russia, each with very different strategies to fight the pandemic. They are materializing the hope of a strong post-pandemic future for the theatrical business to come, though this will take time, certainly not starting before Q2 for many and Q3 for others, given the present high number of Coronavirus cases, the limited rollout of vaccinations, and the release date delays of recent weeks.

If you have comments or questions about Gower Street’s charts and articles; to see higher-resolution images; sign up for our free newsletter, or subscribe to our Road to Recovery reports, which track all the latest news and information worldwide, please visit our website at: https://gower.st.