Warner Bros. Discovery posted weak second-quarter results this week, sending the company’s stock price down to all-time lows. Among waves of bad news in the report, revenues at the company came in more than $350 million lower than financial analysts had expected.

In addition, the company announced an eye-popping figure of $9.1 Billion that it was writing off as a drop in the value of its linear cable assets.

Executives explained that the write-down reflected an industry-wide reevaluation of the value of cable businesses, saying it did not reflect WBD’s operations in particular. This explanation did not calm investors, especially after Warner was left out of the latest NBA rights deal, its most valuable cable asset.

By the end of the week, the company’s stock price was hovering near $7.00, a 50% drop from one year ago and the lowest it has traded since Warner Bros. and Discovery merged in 2022.

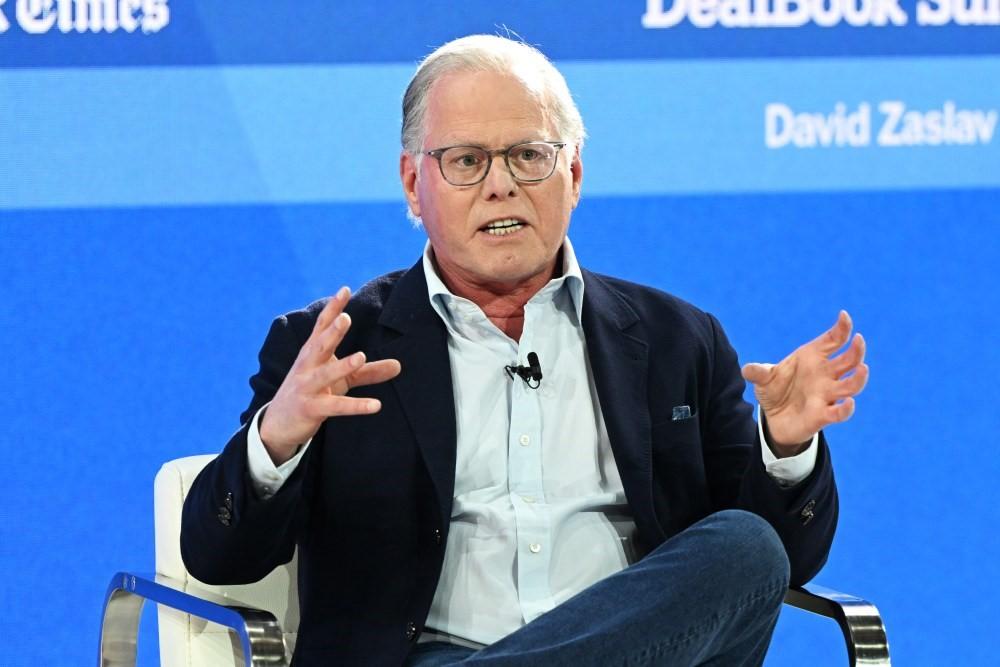

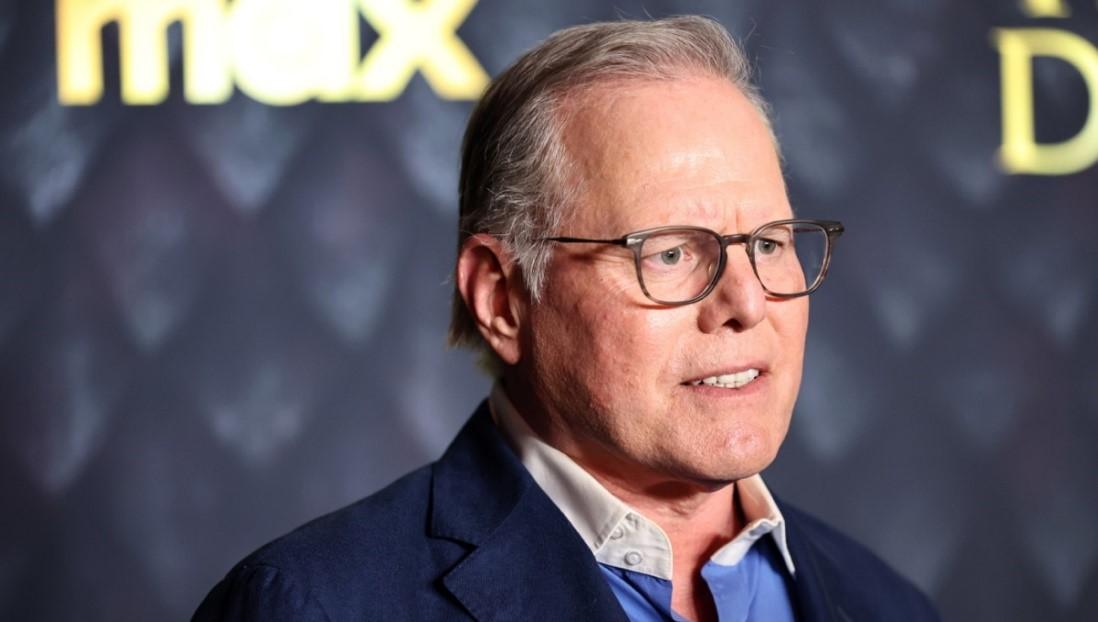

CEO David Zaslav is under siege across many fronts, as more analysts and shareholders question his leadership. Zaslav’s tenure has been marked by dramatic cost-cutting measures including mass layoffs and numerous steps that have ruffled feathers in the industry.

This included his decision to pull the theatrical releases of BATGIRL and COYOTE VS. ACME to benefit from tax write-offs and his more recent statement to the press that Warner “didn’t need the NBA” as the company headed into failed negotiations with the NBA on broadcast renewal rights.