Over the past two decades, Hollywood has been supercharged by mega-mergers among the major players in media and entertainment. Disney went on an industry buying spree with stops at Pixar (2006), Marvel (2009), Lucasfilm (2012) and 21st Century Fox (2019). Comcast scooped up Universal Studios in 2011 and Warner Bros. was swallowed twice, first in 2018 by AT&T and then by Discovery in 2022.

These mergers changed the industry by reducing the number of studios making films for the theatrical market. At the time, many analysts supported these consolidations as beneficial by increasing scale and reducing costs. Shareholders were rewarded with steep increases in the share price of the remaining companies. Low interest rates made debt financing affordable and the U.S. Federal Trade Commission approved these mogul maneuvers.

However, much higher interest rates have taken hold over the last few years, which has contributed to a new focus by investors on profitability over growth. Just making interest payments on the debt left over from these mergers was becoming expensive. In 2021, Linda Khan was appointed as the new chief of the Federal Trade Commission, and under her stewardship the agency became much more suspicious of consolidation among the largest companies in the US economy. Under her leadership, more proposed deals have been challenged, leading to a sharp decline in this activity.

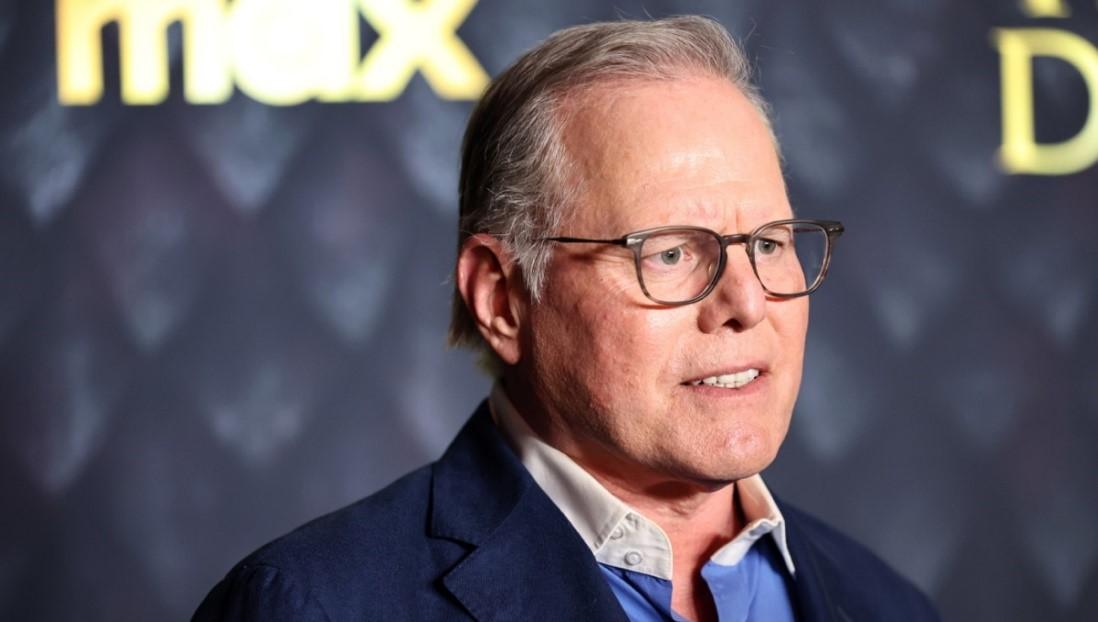

For the foreseeable future, the pace of new mergers among media giants seems to be slow to non-existent. At the end of 2023, there were multiple reports that Warner Bros. Discovery CEO David Zaslav was pursuing an acquisition of Paramount. However, WBD’s fourth-quarter earnings highlighted a company struggling to turn a profit and struggling with a large amount of debt.

As a result, its stock price dropped significantly, making it even more challenging to pursue any large acquisitions. Moreover, the FTC would certainly “review” any proposed merger with Paramount, making the actual pursuit both time-consuming and expensive. Zaslav has confirmed that his interest has cooled in exploring a deal for Paramount.

I would rewire the sentence like this “Under her stewardship the agency became more suspicious of consolidation among the largest companies in the US economy. Khan had the FTC challenge significantly more proposed deals which led to a cooling down in the acquisition market.