The new year kicked off with a modest global box office of $2.25 billion in January. In contrast, twelve months ago, 2023 kicked off with a bang, achieving $3.6 billion, the highest grossing single-month globally since December 2019 at that time. This January is -37% below that.

Of course, in 2023 Chinese New Year was in January instead of February as in most other years (including this year), which inflates the variance. After excluding China from the global box office, the drop to last year is still -13%. However, it is at least up +33% in January 2022.

Four years ago, the COVID-19 outbreak began to force cinemas to close and caused severe damage. The theatrical industry has been on a long road to recovery since. Last year reached new heights with three months performing above the monthly average of the final three pre-pandemic years (2017-2019).

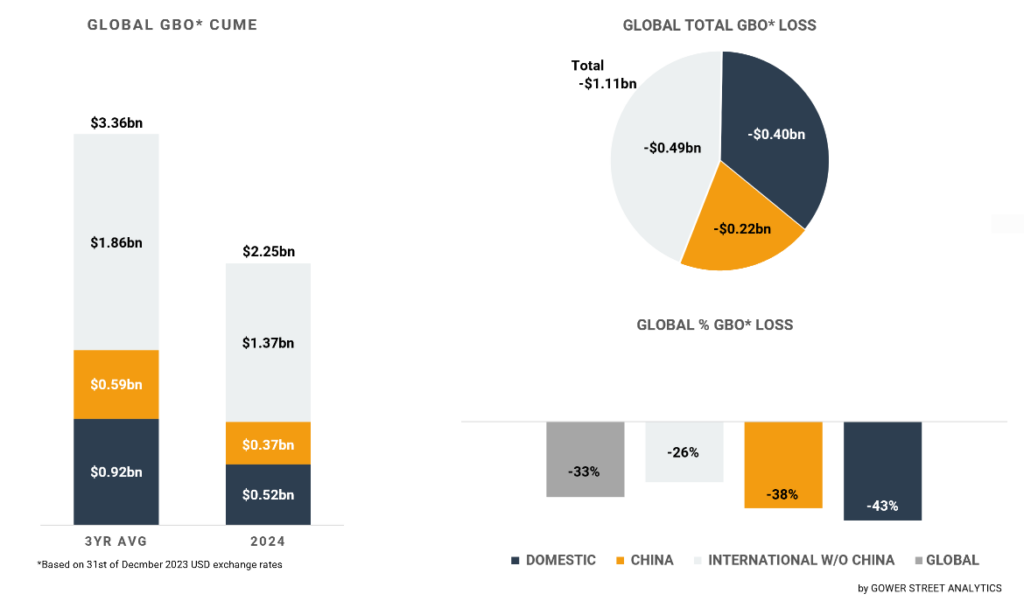

During that upswing, the Hollywood writers’ and actors’ strikes, lasting a combined half-year, put on a break. Since September 2023 it started to have a significant impact on global performance and is continuing to slow the recovery down drastically. This January the global box office (without China) is -32% down on the pre-pandemic three-year average. A bigger gap compared to January a year ago (-22%) and the full-year 2023 result of -17%.

The reduced number of dominating US-tentpole titles is the main driver. Still, multiple releases took advantage of the weak competitive environment this January and were able to harvest their full potential, even shining a light on genres that have not been nurtured in a while.

On this month’s GBOT (above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China, and International (excluding China). The pie chart indicates the current deficit compared to the average of the three pre-pandemic years (2017-2019) and where those losses are coming from. The bar graph on the bottom right displays the percentage drops globally.

In the last two years, single titles were dominating the global box office in January. In 2023 AVATAR: THE WAY OF WATER generated $820 million of its $2.3 billion final. The year prior SPIDER-MAN: NO WAY HOME added $500 million of its $1.9 billion lifetime. This past month multiple US titles shared the global box office more equally.

The month was topped by two holdover titles from Warner Bros. The same two that also led in December. WONKA generated about $179 million within the month for a cume of $558 million at the end of January. AQUAMAN AND THE LOST KINGDOM shipped in another $165 million for a cume of $416 million to close the month.

The biggest global new release in January was the Jason Statham starer THE BEEKEEPER with $111m in the month. This is already higher than the lifetime of the first JOHN WICK ($86m) and WRATH OF MAN ($106m). It will end above THE GENTLEMEN ($115m) and THE KING’S MAN ($126m). Most likely a bit below ANGEL HAS FALLEN ($151m).

Universal’s animated holiday-release holdover MIGRATION added $108 million for a cume of $209 million at the end of January.

The fifth globally released movie crossing $100 million in January was Sony’s breakout hit ANYONE BUT YOU. It contributed $104 million to a total of $135 million. Based on the performance so far, it’ll most likely end in the ballpark of THE LOST CITY ($193m), impressively getting above the lifetime of TICKET TO PARADISE ($169m) and many rom-coms released a decade ago like FRIENDS WITH BENEFITS ($150m), CRAZY, STUPID, LOVE ($147m) and HE’S JUST NOT THAT INTO YOU ($179m).

Another successful female-driven global release in January was Paramount’s MEAN GIRLS. Grossing a monthly total of $86 million. It will most likely end around SISTERS ($106m), a bit below the first PITCH PERFECT ($116m), and the original MEAN GIRLS from 2004 ($130m). Given that the movie was originally scheduled to be released on streaming only, this is a remarkable result.

Finally, Searchlight’s POOR THINGS had a great first month at the box office. Grossing an extraordinary $59 million. The Golden Lion winner will surpass director Yorgos Lanthimo’s prior awards hit THE FAVOURITE ($96m). How far the 11-time Oscar-nominated film can get will depend on the number of awards it’ll receive at the end.

The biggest part of the global box office in January was delivered across the International market (excluding China) with a worldwide box office share of 61%. That is the highest share since December 2022 (63%). The sub-region of Europe, Middle East, and Africa (EMEA) stood out again, delivering 59% of the International market (excluding China), the second-highest share since October 2022, just behind 61% in November last year.

EMEA recorded its fifth-highest-grossing month of the past 12. Historically January is the second-highest-grossing month of the year in the sub-region. Consequently, referring to the gap against the monthly three-year average January was just ranked 7 of the past twelve months with -21%.

Compared to January last year the month was down -7% and up +47% against the same period in 2022. Better than the global results in January. Most of the main global releases performed best here. Seven of the top 10 international markets for THE BEEKEEPER, ANYONE BUT YOU, POOR THINGS, and MIGRATION were from EMEA; further six for WONKA and MEAN GIRLS.

Of all EMEA territories, the Netherlands achieved the most remarkable result. In January it performed +5% above the territory’s three-year average benchmark. That is even better than the +3% it recorded for the whole of 2023, as the only tracked top 15 market to finish that year ahead of its pre-pandemic average. It was still down in January last year by -6%.

The success of two local titles was a key element for the outstanding outcome. The #2 title of the month was BON BINI: BANGKOK NIGHTS. It’s the fifth installment of the local comedy franchise and it’s already the second-highest-grossing. The #4 movie was the sequel DE TATTA’S 2.

The other two sub-regions performed on a significantly lower level than EMEA. Asia Pacific (without China) and Latin America both had a similar downfall in January year-on-year being -19% and -20% behind. From a total box office point of view, the month’s grosses rank #7 and #8 within the past 12 months. Referring to the gap against the three-year average this looks worse. The -33% of Asia Pacific (without China) is the third widest gap; the -34% of Latin America represents the biggest gap.

On the Domestic market, the performance in January was even weaker. It was -43% below the three-year average; after South Korea (-57%) and Taiwan (-54%) the lowest number of the tracked top 15 markets. That is the second widest gap of the past 12 months and clearly below the -21% for the whole year of 2023. Further the $521 million the Domestic market reached in January is the third lowest in the past ! 2 months, -12% below the same month last year and +33% above 2022.

No title was able to get above $100 million in the month for the first time since September last year. Only WONKA ($63m) and MEAN GIRLS ($62m) were able to crack $50 million. The additional four titles above $40 million are a solid mark, but not enough to overcome the absence of a breakout grosser.

Despite being nearly independent of the Hollywood output these days, the Chinese market wasn’t performing much better than the Domestic market. Its $367 million box office in January was also just the third lowest grossing month of the past 12. The gap of -38% against the three-year average, was only the fourth lowest. This January was marginally down against the same month last year (-4%) and a bit more against the one from 2021 (-21%).

The market was resting before Chinese New Year when a phalanx of tentpoles revitalized the box office. In January two late December releases stood out and generated roughly half of the box office (49%). Local comedy JOHNNY KEEP WALKING managed to cross $100 million adding approximately $127 million to its $174 million total. It was followed by Hong Kong crime thriller THE GOLDFINGER contributing $51 million of its current cume of $79 million.

The January global results were expected to be modest. The strike-caused production delays dried out the release calendar and have been pulling down the global box office performance for months now. In that context, the actuals were in the forecasted ballpark.

Single titles were even able to leverage the less crowded marketplace. That could even help to create successful blueprints for certain kinds of movies, which were not in theatres in a while. Leading to a more colorful palette of movies being released theatrically in the future, strengthening the market landscape.

A more consistent, uninterrupted, diverse, and commercial release calendar is needed to reduce the current volatility of the theatrical market. To get back and beyond the pre-pandemic box office levels. January was one month more near to a release calendar of that kind. It will gradually improve over the running year.