2023 was a bittersweet year at the box office. Many peaks have been reached in the theatrical world in the past year. July ($4.6bn), August ($3.7bn), and January ($3.6bn) were the three highest global grossing months of the current decade.

The first three quarters of 2023 each topped the other to be the highest-grossing quarter since 2019. The third quarter even performed above the monthly average of the last three pre-pandemic years (2017-2019) by +3%.

After a strong first eight months, a more limited release schedule compared to pre-pandemic standards challenged the market. A writers’ and actors’ strike in Hollywood that, combined, lasted for half a year from May until November started to impact the box office of the theatrical industry at that point. The strikes reduced the dominating US titles on offer, limited the marketing of releases for the time of the actors’ strike, and caused a slowdown of the post-pandemic recovery.

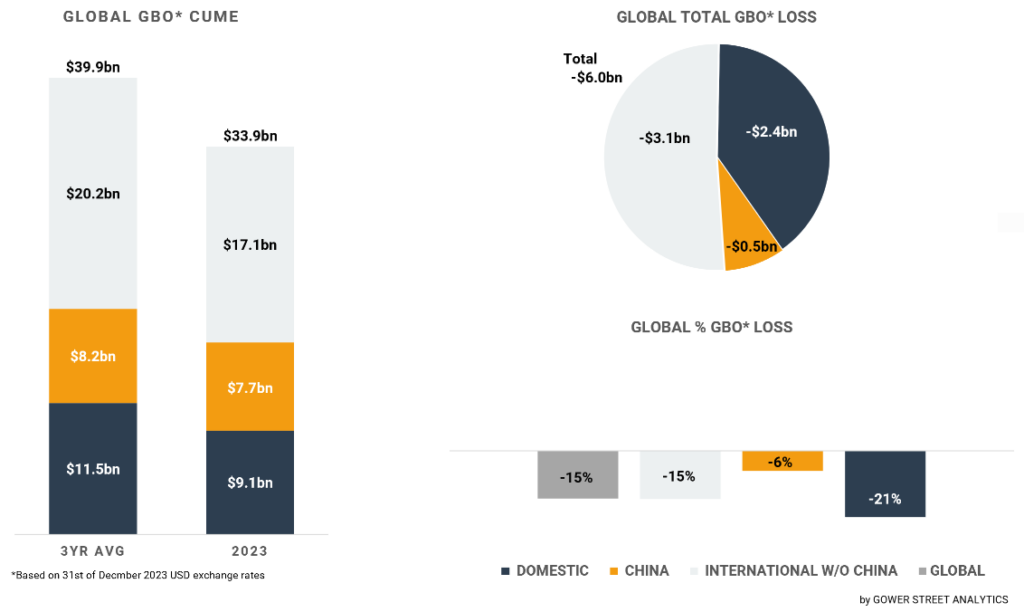

Still, 2023 ended with a global box office of approximately $33.9 billion. That’s a remarkable +31% growth on the prior year ($25.9bn). The highest grossing year since the record-breaking $42.3 billion of 2019. The global box office gap to the pre-pandemic three-year average is -15% or roughly $6 billion in current US$-exchange rates. That’s a huge improvement to the prior recovery years, when the gap was significantly bigger (2022: -35%, 2021: -48%, 2020: -70%).

In its final month, 2023 did not end on a high nor was it a low. December generated a box office of $2.8 billion. That makes it #7 in the year’s monthly ranking, marginally behind May (-0.3%) and April (-3%). It’s up on the prior three months, being the highest-grossing month since August; a stable middle ground within the year. Against December last year, it’s +14% up and in the same ballpark as the month in 2021 (-1%).

On this month’s GBOT (above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China, and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three pre-pandemic years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

In contrast to last year, when AVATAR: THE WAY OF WATER solely dominated the December box office, this past month multiple titles shared the box office more equally.

WONKA was the clear winner with a monthly total of $379 million. The holiday hit already outgrossed MARY POPPINS RETURNS ($350m) and PADDINGTON ($268m). It will end in the year’s global Top Ten releases, most likely a bit ahead of THE LITTLE MERMAID ($569m) and behind SPIDER-MAN: ACROSS THE SPIDER-VERSE ($685m) at #7.

The second highest-grossing title in December was AQUAMAN AND THE LOST KINGDOM with a monthly box office of approximately $251 million. It will most likely end a tad above BLACK ADAM ($393m) and MEG 2: THE TRENCH ($398m), below ANT-MAN AND THE WASP: QUANTUMANIA ($476m).

This is clearly above the year’s earlier DC releases THE FLASH ($271m) and SHAZAM! FURY OF THE GODS ($134m), but just a bit over a third of the tremendously successful first AQUAMAN, which grossed $1.15 billion in 2018.

The holiday season is usually a big time for animated movies. This year two animated titles were in the top group of the month global box office. Disney’s November holdover WISH added approximately $127 million for a cume of $176 million at the end of December. Based on the current result WISH will most likely finish around the level of ENCANTO ($258m), between LIGHTYEAR ($227m) and FERDINAND ($296m).

MIGRATION achieved a monthly result of $101 million. It still has multiple major territories to open with the UK, South Korea, and Japan. Based on the performance so far, it’ll most likely end in the ballpark of FERDINAND ($296m) and THE GOOD DINOSAUR ($332m). Clearly below last year’s Christmas offer PUSS IN BOOTS: THE LAST WISH ($485m).

Two other November holdover releases contributed substantially to the December box office. THE HUNGER GAMES: THE BALLAD OF SONGBIRDS & SNAKES generated about $103 million within the month for a cume of $323 million at the end of December. NAPOLEON shipped in another $101 million for a cume of $207 million to close the year.

The biggest part of the global box office in December was delivered across the international market (excluding China) having a worldwide box office share of 54%. Over half of that (56%) was generated in the sub-region of Europe, the Middle East, and Africa (EMEA).

EMEA recorded its fourth-highest-grossing month of the year. Compared to December in prior years, the same period was slightly up against 2022 (+3%) and 2021 (+7%). Nevertheless, the gap against the three-year average was at the lower end (#9) for the year with -25%. This further regressed the deficit for the running year to a final of -15%, mirroring the global level. This followed the reduction from -23% to -9% in the April to August period.

The sub-region’s yearly box office grew by +25% in 2023. The regional performance was led by the Netherlands being up +31% against 2022 and +3% above the three-year average. It’s the only tracked top 15 market to finish 2023 ahead of its pre-pandemic average. Germany was just -7% below, and +28% up on 2022. France followed strongly being -11% behind the pre-pandemic average, growing +20% in 2023.

Italy struggled for a long time since the start of the pandemic, being behind most other markets in the recovery process. This year Italy made a huge step forward, catalyzed by multiple industry initiatives and a huge local hit. The country had the biggest year-on-year gain of the region with an impressive +62%, narrowing the gap against the pre-pandemic average to -16%, down from -48% in 2022.

UK/Ireland performed a bit lower than the sub-region’s average. The #3 International market in 2023 just grew by +9% year-on-year and still stands at -22% below the three-year average.

Of the three sub-regions, Latin America had the highest gain in the prior year with +32% and the lowest gap to the pre-pandemic average with just -8%. However, its year ends more on the low end. December was the third lowest grossing month of the year, closing a second half of the year, that was -14% below the stellar first half of 2023.

The sub-region of Asia Pacific (without China) also had just a modest second half of 2023. Finishing only as the third highest of the decade, being slightly behind the prior two half-year periods (1H 2023: -4%, 2H 2022: -2%). Of the three sub-regions, Asia Pacific (without China) has the lowest 2023 growth against the prior year with +9% and the biggest gap against the three-year average with -20%.

Japan is still globally one of the best-recovered markets, being -6% below the pre-pandemic average. Nevertheless, Japan’s year-on-year growth is at the low end with +4%. Australia had the same small increase but on a minor level. Lagging the three-year average with -19%. Of all major markets, South Korea stays furthest away from its pre-pandemic level: -31% below. Its recovery further slowed down to a disappointing +9% increase against 2022.

China operated on the opposite end, growing +83% in 2023 compared to the poor-performing prior year. Finishing with a total of $7.7 billion; the fourth highest grossing year ever! The gap against the pre-pandemic three-year average was a modest -6%. In September that metric even reached +1%, but the following months increased the gap again.

In December the Chinese market recovered and performed the highest box office since August with $551 million, being -11% below the three-year average. It was the highest-grossing December in China since 2019.

The box office was spread among many titles, while no release crossed the $100 million mark within the month. Thirteen, mainly Chinese, titles generated over $10 million. Local crime drama ENDLESS JOURNEY topped the list with $78 million, just a glimpse ahead of the local TV series SHINING FOR ONE THING, which took in $77 million in the final two days of the month. AQUAMAN AND THE LOST KINGDOM ranks #3 with $46 million in December. It’s a solid result, but the sequel will end around -80% below the first installment, which generated $292 million.

Like China, the Domestic market had a broad set of titles generating significant box office in the final month of 2023; 18 titles crossed $10 million in December. That is the highest number since November 2019! Nine titles even crossed $30 million, which hasn’t happened since February 2020. At the same time, only WONKA was able to cross $100 million ($133m).

The monthly total of $773 million was the sixth highest result of the year, +12% in December 2022 but -19% down on the same period in 2021. Due to seasonality, the gap against the three-year average was still the third worst of the year with -36%.

Consequently, the year ended -21% below, after cutting the deficit to -15% in August, down from -36% at the start of April. Accumulating an estimated $9.07 billion made the Domestic market the #1 global market again in 2023, after losing that position in 2020 and 2021 to China. Still, the distance between them closed a bit to +18%, narrowed from +74% in 2022.

2023 reached new milestones on the long road to recovery following the Covid-19 pandemic. The accelerated growth of the past two years demonstrated the strength and resilience of the cinematic world. Multiple records on title, territory, regional, and global levels have been broken. Where a competitive release calendar and attractive content were on offer, the audiences were there.

The lack of a continuing flow of attractive and commercial products has been a major obstacle to the recovery. A more evenly split out, diverse release schedule is key to having a chance to get back to and beyond pre-pandemic box office levels. That won’t change in the new year. The impact of a six-month strike in Hollywood on the release calendar, in terms of global-appeal Hollywood products, is significant.

It slowed down the global box office in the final quarter of 2023 and it will continue to do so in 2024. Nonetheless, gaps in the 2024 release calendar can also offer opportunities for both non-Hollywood titles and alternative offerings to shine. This has been proven frequently since the pandemic disrupted both production and release cycles in 2020.