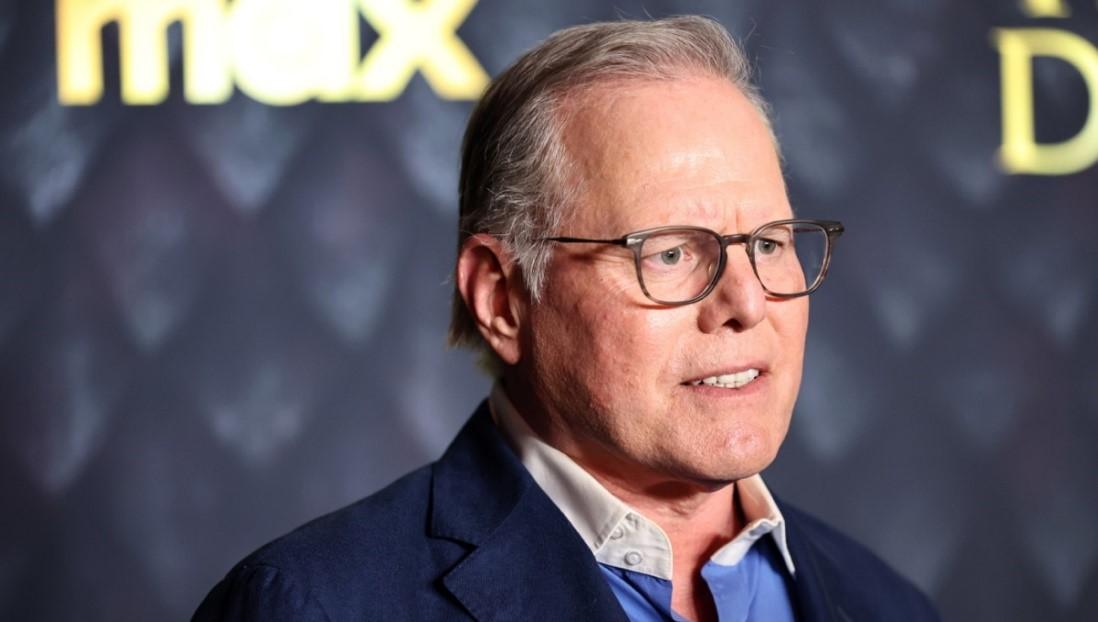

Coming at the end of a chaotic year in the entertainment industry, this week may have delivered the biggest news yet with Axios reporting that a meeting took place on Monday between Warner Bros. Discovery CEO David Zaslav and Paramount Global CEO Bob Bakish to discuss “the possibility” of a merger between the two media giants.

Paramount may be looking for a way out from underneath the intense financial pressure it is experiencing, as a result of the declining value of its cable networks and significant losses from the company’s streaming platform Paramount+.

Due to the significant overlap between the two company’s studios, cable, and streaming operations, WBD could benefit from folding in Paramount’s business by increasing revenues without adding significant costs.

However, the risks of this merger are equally clear. WBD has $45 billion in debt after its spin-off from AT&T and merger with Discovery. The company has spent the better part of 2023 trying to cut costs and pay down its debt. Taking on additional debt to finance a new merger would seem a step in the opposite direction.

The track record for recent mega-mergers in the media and entertainment market is spotty at best. Disney’s $71 billion acquisition of 20th Century Fox in 2019 is widely seen as a failure, with Disney considering a sell-off of some of the assets at a loss.

AT&T’s 2016 acquisition of Time Warner (including Warner Bros.) ended in 2022 with a costly spin-off of the studio and a merger with David Zaslav’s Discovery. This checkered history has caused investors to be skeptical, with the share price of both Warner Bros. Discovery and Paramount Global falling in response to news of the potential merger.