After July recorded a global box office that proved not only to perform above pre-pandemic levels but to be the biggest July result of all time the pressure was on for August. Despite media coverage of some individual disappointments in the August release calendar the month proved that July was not just a one-off testament of strength!

August was the second month in a row with a monthly global box office on or above pre-pandemic levels. The month’s 2023 result finished +1% ahead of the August average of the last three pre-pandemic years (2017-2019). Prior to July, which was +17% up on the pre-pandemic average, only one month had surpassed pre-2020 levels: January this year (+6%).

August achieved a global box office of $3.6 billion. That makes it the second-highest-grossing month since December 2019, following July’s $4.5 billion. It’s the culmination to date of a lengthy recovery process. This July and August are two of just four months in the current decade that crossed more than $3 billion globally.

August is also the 9th consecutive month to gross at least $2 billion. Prior to that, only the four months from May to August 2022 crossed that threshold. This illustrates the consistency and strength the global box office has regained after COVID-19 put the break on the theatrical industry more than three and a half years ago!

At the end of August, the total global box office is estimated to have reached $24.6 billion. This is currently tracking +35% ahead of 2022 and more than doubles 2021 (+122%) at the same stage! After already overtaking the full 12-month box office result of 2020 ($11.8bn) in May, the running total crossed the final result for 2021 ($21.3bn) in early August.

The full-year result of 2022 ($25.9bn) will be reached during September, over three months before the year ends! The current year remains -9% (or $2.6 billion) behind the pre-pandemic three-year average but that gap has narrowed significantly from -17% at the end of June.

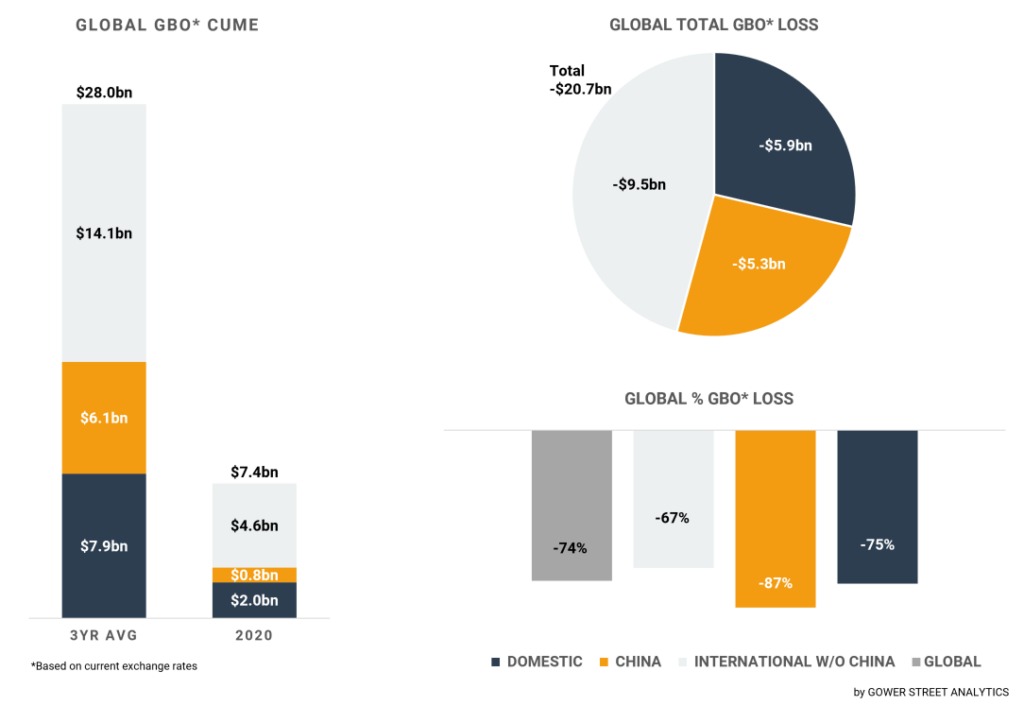

On this month’s GBOT (above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China, and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three pre-pandemic years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

“Barbenheimer” continued its reign and accounted for an estimated $939 million (26%) of the global August total. BARBIE added approximately $550 million for an astonishing $1.38 billion cume. It just surpassed THE SUPER MARIO BROS. MOVIE ($1.36 billion) to become the #1 movie of the year. BARBIE is also now the highest-grossing movie for distributor Warner Bros. in its 100-year history! Globally BARBIE currently ranks as the #15 movie of all time, just behind AVENGERS: AGE OF ULTRON ($1.41bn).

OPPENHEIMER added approximately $389 million within the month for a current cume of $854 million. It is now the #3 movie of Christopher Nolan, just behind THE DARK KNIGHT RISES ($1.1bn) and THE DARK KNIGHT ($1bln) and ahead of INCEPTION ($837m). For the running year, it is #3 globally, having just overtaken GUARDIANS OF THE GALAXY, VOL. 3 ($846m) after opening strong in China this past weekend.

The biggest global new release in August was MEG 2: THE TRENCH with a monthly total of $364 million. The international box office accounted for 79% of the box office. The only other global release that grossed over $100 million in August was TEENAGE MUTANT NINJA TURTLES: MUTANT MAYHEM, achieving $143 million. In contrast to MEG 2, it was Domestic market leading, with North America contributing 71% of the film’s cume.

China relied largely on its own roster of hits again in a fabulous August. Local thriller NO MORE BETS generated an impressive $487 million and dominated the month. Holdover fantasy CREATION OF THE GODS I: KINGDOM OF STORMS added $180 million for a current cume of $353 million. Chinese-US Co-production MEG 2: THE TRENCH accounted for $117 million in China. At #4 local comedy PAPA grossed $68 million, while holdover comedy drama ONE AND ONLY added $64 million for a current cume of $126 million.

These five movies were responsible for 86% of the $1.07 billion that China delivered in August. It’s the second consecutive month crossing $1 billion. That is the first time this decade that that has happened. It’s also the first time that three consecutive months crossed more than $500 million, the prior peak was two in January and February this year.

August marked also the third month in a row that China performed above the pre-pandemic three-year monthly average with +8%. The Domestic market played in the same ballpark in August with +7%! Beating the pre-pandemic benchmark just for the second time after July.

While August is historically the second most lucrative month in China after February, the opposite has to be said about the Domestic market. August is historically its third lowest grossing month of the year, which is visible in the total grossed amount. After two months above $1 billion, in August the domestic box office achieved $834 million. That will make at least the #8 month at the end of the year.

By far the two biggest global theatrical markets made significant progress in their recovery process. At the end of August, the Domestic market has a cume of $6.7 billion in 2023. Last year this number was not achieved before November, over two months later. The gap to the three-year average has narrowed to -15% from -23% at the end of June! In China, the cume of $5.9 billion is even +1% above the pre-pandemic benchmark, while the market was -10% only two months ago.

Regionally Europe, Middle East, and Africa (EMEA) had a very strong August, coming in +11% above the three-year monthly average. This marks the second time EMEA has beaten pre-pandemic levels after July (+18%). August also marks the second-highest-grossing month for EMEA since January 2020 (before the impact of the pandemic was felt in Europe) with $934 million. That narrows the gap to pre-pandemic levels to –9% from -17% at the end of June.

The region was carried by great performances in multiple major markets, which were around or above their pre-pandemic three-year average, including Austria (+42%), Italy (+36%), Spain (+5%), France (+3%) and UK/Ireland (-1%). The Netherlands was +25% above the pre-pandemic average and also nearly recorded its highest-grossing month of the decade, only -2% behind the current best in July. Germany topped July and achieved its highest-grossing monthly result of the decade, also coming in +42% above the pre-pandemic three-year average in August. For the running year, these two territories are now above the average pre-pandemic cume, the Netherlands (+10%) and Germany (+6%).

The Asia Pacific region (exc. China) saw its third highest-grossing month since December 2019, just a glimpse behind July (-1%), the highest so far. Compared to EMEA the territory performance was a bit more stretched. Australia (+26%), New Zealand (+21%), Malaysia (+12%) and Taiwan (+2%) were performing above pre-pandemic levels.

In contrast, the top two markets, Japan (-26%) and Korea (38%), were clearly below. Still, both markets had their second-highest-grossing month of the year. For Japan and South Korea, August is, historically, the most lucrative period of the year. This year both just didn’t fly as high as before the pandemic and last year (Japan -17%; Korea -6%). That pulled the regional gap to the three-year average down to -22% in August. For the running year, it’s at -16%, just marginally better than at the end of June (-17%).

Latin America is still fairing best of the three International sub-regions in that aspect, with 2023 just -3% behind the average of 2017-2019, the same as last month. After four consecutive months with business tracking ahead of the pre-pandemic average, August was a modest -6% below, which prevented the gap for the running year closing further.

All in all, it was a tremendous summer at the global box office, producing numbers that haven’t been seen since the pandemic on such a level and with such consistency nearly all around the world. The four remaining months of 2023 will be a bit more challenging again compared to the summer prime. For a long time, it was expected that the number and frequency of attractive global new releases out of the US would decrease a bit again in that period.

The ongoing strike dispute in Hollywood is amplifying it. Besides the marketing challenges the strike creates, it’s having an impact on the release calendar. After the upcoming GHOSTBUSTERS sequel, KRAVEN THE HUNTER, and CHALLENGERS already moved out of 2023 last month, DUNE: PART TWO changed its release date from November to March 2024.

The longer the strike lasts, we are likely to see more films postponed causing growing gaps in the release calendar and a slowdown of the global box office growth. A key element to the theatrical summer success was the combination of increased title numbers and variety, and major individual box office hits. To get back to and above pre-pandemic heights permanently this needs to be the modus operandi. Long-lasting strikes are delaying this.