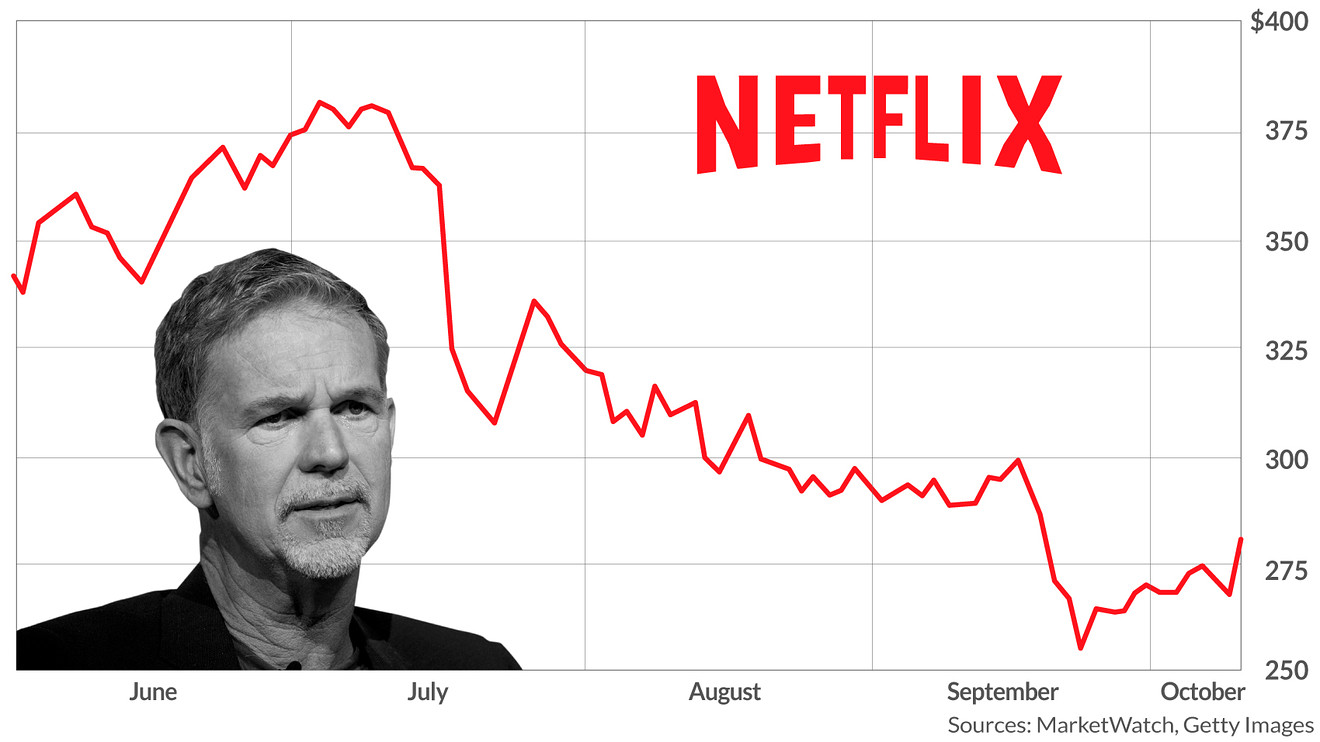

On Friday, Netflix stock plunged by more than 20% after the company admitted in a letter to investors that it faced significant challenges ahead to maintain the pace of its growth. While fourth-quarter revenues actually exceeded analyst expectations, Netflix expects that it will face significant competitive challenges from rival streamers and traditional Hollywood studios as they expand online. The company is finding it increasingly difficult to signup new subscribers, especially in the U.S. and markets where it is well-established.

The investor letter noted that “added competition may be affecting our marginal growth some,” the first time that the company has acknowledged officially the negative impact of the “streaming wars” on its bottom line. Moreover, its costs continue to climb to create the constant flow of new original series and feature films that Netflix has committed to producing.

After a historic run for the past two years, Wall Street appears to be reconsidering its outlook on streaming stocks. Disney shares have also dropped by more than 25% from their peak in 2021, based on the expectation of lower growth rates for Disney+ and increasing costs in production and marketing. It may be that the post-pandemic phase of the streaming market is dawning, in which hyper-investment and expansion are replaced by a focus on profitability.

See also: Netflix plummets 24%, on pace for its worst day since July 2012 (CNBC)